Eight key ‘plays’ to alter how work is managed and performed.

Greg Bolino is managing director within Accenture’s Strategy for the Utilities industry group. Jack Azagury is global managing director for Accenture Smart Grid Services.

These may not seem like the best of times for electric utilities. Market conditions are difficult. The centralized grid model is challenged by distributed generation. Weather events have put pressure on reliability. Regulators continue to squeeze allowed returns, even while investor expectations have fallen - both for growth in earnings and for return on investment.

An equally daunting challenge will come in meeting customer expectations. Customers today are accustomed to the sorts of high-quality digital experiences they've seen through their interactions with providers in other industries. By contrast, they have little trust in their utility companies. And at the same time, powerful, low-cost technologies such as mobile and the cloud, and growth in new energy technologies, make market entry easier for new competitors.

Utility executives are finding, however, that while digital poses a challenge, it also presents a massive opportunity. Adoption of digital capabilities - mobility, analytics, cloud, social media, e-commerce and connected devices - can improve performance across the entire utility value chain. It can bolster operating performance and open opportunities for growth of new services and new business models.

A Steep Hill to Climb

New technologies such as distributed generation are growing much more rapidly than expected. A prime example is solar, which, along with storage, will continue to be the big disrupter. And while it still only accounts for 0.3 percent of US generation, the addressable market is every rooftop in the country. Solar is now at grid parity in 10 states, and likely reaching 14 by the end of this year. Our analysis shows that the entire country could be at grid parity by 2030, especially as solar prices continue to drop.

Our research shows also that 85 percent of utility executives expect increased competition from new entrants in the areas of beyond-the-meter solutions, distributed generation and data services.

Figure 1 - Digital Technology: Transforming Business

Figure 1 - Digital Technology: Transforming Business

These and other factors are making utility investors wary. In Europe, the top 20 utilities have lost 50 percent, or half a trillion euros, of market value since 2008. In the US, investors have reduced their earnings growth expectations in all but a few utility stocks. Their skepticism is based on a lack of a compelling story about growth, and significant threats from market forces, including regulation.

On one hand, the utility value chain is already becoming more digital. Examples include intelligent devices on the grid, an advanced communications network, and digital customer channels. But these capabilities have not been adopted at scale, nor have they been used to fundamentally alter how work is managed and performed.

As a result, utilities still face numerous obstacles as they seek to improve operational efficiency and increase profitable growth.

For example, many utilities lack the data and analytical capabilities needed to evaluate capital investments based on real-time conditions, rather than static planning assumptions. Typically, utility planners use annual 'peak load' snapshots to make investment decisions.

Figure 2 - Consumers Prefer Digital

Figure 2 - Consumers Prefer Digital

Likewise, utilities employ mostly time-based maintenance practices, partly due to regulation, but mostly due to the lack of robust risk models to re-evaluate maintenance intervals. And although most have invested in work management systems, utility field and plant workers generally are not fully enabled with mobility or advanced scheduling, often because of a lack of standard work practices. Similarly, the capture and storage of asset documents and data is often manual or cumbersome because of a lack of a unified information platform.

For another example, current management practices limit the ability to actively manage the grid, and many utilities have been unable to capitalize on the data generated by smart meters and other grid devices, making it difficult to improve power economics.

Utilities also have found it particularly difficult to develop new products and services to meet changing consumer needs and exploit new opportunities, because they lack true experience and insights on customer behavior, and are often hampered by inflexible customer systems.

Pathways to Growth

In most industries, leading companies are embracing digital technologies as a core component of their growth strategies. One high-end retailer intends to become the first company that is a fully digital "social enterprise". Another retailer has a vision to give customers "anywhere, anytime access by combining the smartphone, online shopping and physical stores", while one large consumer goods company has scaled efforts to drive its business with digital marketing capabilities. Google's recent purchase of Nest signals that industry boundaries are being tested and broken using digital capabilities.

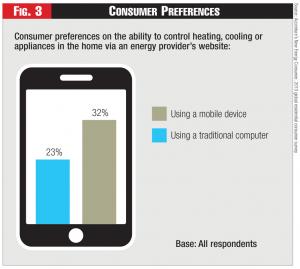

Figure 3 - Consumer Preferences

Figure 3 - Consumer Preferences

Utilities are not alone in seeing both threats and opportunities from the acceleration of digital in their value chain. Our research finds that across 12 different industries in 20 counties, 52 percent of C-suite executives expect digital technologies to transform or significantly change their industries in 2014. And 59 percent say that most of their current digital investments are focused on process efficiencies and cost reductions (Figure 1).

For utilities, changes already are under way that will facilitate the move toward a digital value chain and create new opportunities. The acceleration of distributed and variable energy sources is creating a grid with smarter end-points. Employees are pushing for digital innovation to make their jobs easier and more interesting. The explosion of data from meters, customers, assets and other sources creates an environment ripe for exploration with sophisticated analytics, while the deployment of new digital assets, such as smart meters, makes it easier to track results and make decisions based on real-time information.

Analytic capabilities are definitely a priority for utilities, with 75 percent of utility executives indicating it is their highest priority smart grid investment over the next six years. We believe that advanced, enhanced analytics will be essential for companies hoping to achieve the potential value of the digital grid, in areas including grid operations, asset management, outage management, advanced metering infrastructure (AMI), revenue protection, customer service and new products. Excluding new products, the potential value of applied analytics could approach $40 to $70 per electric meter per year.

Other digital capabilities are becoming priorities as well. The deployment of mobile applications can increase worker efficiency and maintenance effectiveness, lead to shorter outages and enhance customer service. Mobile and social communications have become critical during outages, as evidenced during Super Storm Sandy when smartphone traffic to utilities' websites increased by 16,000 percent.

The digital utility: Transforming for value and growth

The digital utility: Transforming for value and growth

But, viewing each of these digital capabilities as separate opportunities misses the point. Viewed together, and in a very specific context, these capabilities represent the opportunity to transform the utility business in fundamental ways.

In this light, we have identified eight key digital 'plays' that utilities can undertake to realize the potential of these innovative technologies:

1. Digital Asset Management

2. Digital Field Applications

3. Optimizing Commercial Operations

4. Interactive Demand Optimization

5. Intelligent Grid Operations

6. Digital Consumer Interaction

7. Digitally Enabled Products & Services

8. A Digital Enterprise Model

Eight 'Plays' for Utilities

1. Digital Asset Management. This first play offers utilities a way to improve return on capital and optimize their investments in costly capital assets.

In the telecommunications sector, the need to change investment regimes came just after the year 2000 when cable companies and hundreds of independent providers entered the market using IP telephony. Before this disruption, most of the industry capital would have focused on expanding traditional switch capacity. Suddenly, investments had to be realigned using sophisticated analytics to balance traditional gear with digital infrastructure like DSLAMs for DSL and packet switching capacity in the metro area networks.

Utilities face a similar shift. In the face of lower returns and rising capital spend, utilities need not only to pinpoint the best places to deploy capital, but also need to balance investments in more smart devices and connect to rapidly expanding distributed generation. As an example, some US utilities are exploring the use of solid oxide fuel cells and storage to mitigate or defer the costs of substation upgrades.

When asset data is integrated across operational systems with advanced probability models and heuristics to provide a comprehensive view of the condition of assets - such as their risk, utilization, and overall health - utilities can establish a real advantage.

A disciplined investment regime using asset risk models can help prioritize investments based on their actual impact, and, when necessary, can prompt a shift to more efficient areas based on comparisons of reliability versus expenditure.

For example, utilities can use bottom-up hourly demand to model load, predict risk areas and revise distribution plans to help direct investments and assure efficient sizing of system upgrades and new service connections.

Better data on asset performance, combined with risk analytics, can support a shift from time-based models to reliability and value-centered maintenance approaches.

Using bottom-up, real-time data across operational systems to determine performance and condition of assets is the core capability underlying these changes. In addition to longer asset life and better system reliability, our analysis suggests that utilities could reduce their capital expenditure by five to 10 percent through better targeting of investments (to be reinvested), and to lower maintenance costs by 10 to 20 percent through reliability-centered maintenance.

2. Digital Field Applications. Field workers using digital applications can improve the productivity of field and plant processes by adopting new mobile solutions powered with advanced analytic capabilities.

Telecommunications and cable companies now use sophisticated analytics to determine whether home visits are likely to be completed successfully (scanning both internal conditions as well as social media). Car services Hailo and Uber show customers the real-time location of the cars en route to their pick up point, giving greater visibility and control to the customer.

The digital worker can be enabled by management of the supply and demand of resources from source to site, including procurement, supply chain, fleet and storeroom, and logistics. That can also support work coordination and planning, improve crew safety and improve productivity, while the consolidation and standardization of back office support functions can promote consistency, leading to lower costs and greater efficiency. For example, some utilities already provide tablets to crews with map-based visualization and real-time awareness of all other crews, plus weather information, smart meter data, and outage and distribution management information. All of this helps to drive significant improvements in outage restoration performance and customer satisfaction.

By leveraging analytics and mobility in this way, our estimates suggest that utilities can add one to one and a half productive hours to each field worker's day and can enhance field productivity by 10 to 25 percent.

3. Commercial Optimization. This third play can improve utility profitability and optimize market operations, particularly through the use of advanced analytics to improve forecast accuracy, production and portfolio optimization. Optimization methods can support long, mid-term and real-time power production planning, market analysis and improvement of return on risk.

Like integrated oil companies, utilities can take advantage of fully integrated, multi-commodity energy trading and risk management solutions collecting data from several internal and external sources and using sophisticated models to manage physical and financial market positions. Utilities can realize significant efficiencies in energy trading and production, particularly in competitive markets. The benefits include lower production costs, greater revenues and higher margins, as well as improved hedging and reduced risk exposure.

4. Interactive Demand Optimization. With this fourth play, utilities can maximize the value achieved from managing energy usage, controlling distributed energy resources, and influencing customer behavior.

Banks, in response to a rise in the level and sophistication of fraud, instituted 'interactive' fraud management practices -

a credit card holder is notified in real-time when a charge is flagged as suspicious by sophisticated pattern algorithms. The charges are only authorized by the merchant when the customer validates the transaction.

Digital customer interfaces, such as mobile applications and web capabilities, could allow utility customers to manage preferences and provide interactive feedback on energy use and curtailment actions. By integrating customer information and grid and asset information, utilities can profile customer usage and actively target customers with the best usage profiles, and coordinate real-time demand actions with interactive feedback from the customer.

This real-time integration can help utilities get better value from demand response programs. And in the future, it can help them set interactive price and control signals for distributed generation, and make the most of storage and electric vehicle usage.

The ultimate goal for demand optimization is to tie customer usage to grid optimization and management in real-time. Utilities mastering these capabilities could see better DR participation in terms of targeting and customer value; lower marketing spend per customer; reduction in peak load, and decreases in energy consumption of as much as 10 percent, according to our analysis.

5. Intelligent Grid Operations. Utilities also can improve their profit on total energy delivered while improving system reliability.

Airlines have created sophisticated route management departments that analyze and optimize pricing and schedules on every flight. Transportation and pipeline operators have adopted similar practices using analytics to maximize margin on every route or segment of pipe.

The utility network also is becoming increasingly intelligent, but too little effort is focused today on systematically optimizing the economics of energy distribution. Real-time grid analytics could allow utilities to improve margin on energy delivered through techniques like conservation voltage reduction (CVR), optimizing power factors, and reducing line loss. Distribution automation could make potential results even more dramatic. For an average-sized utility, a reduction in system average voltage of one volt could yield a saving of roughly $50 million in power costs. Several pilot projects conducted under the American Recovery and Reinvestment Act (ARRA) and focused on CVR achieved reductions of four to six volts in areas tested. Few utilities are optimizing voltage on the grid at scale.

Intelligent devices like network sensors and smart meters, coupled with intelligent outage management systems (OMS), can detect and isolate faults more quickly and aid in the restoration of the network. Multi-channel interactions - including social media, text, chat, web, and mobile applications - can also help sense failures, communicate status of restoration, and manage customer notifications and preferences. Our experience shows that better outage prediction and management can lead to a 25 percent reduction in equipment-related outages and a five percent reduction in the cost of weather-related outages.

6. Digital Consumer Interaction. Utilities can reduce cost and improve customer satisfaction by interacting with customers more using digital channels. Many industries already have achieved substantial adoption of digital channels.

In the early 2000's, telecommunications companies migrated successfully to web-initiated orders for provisioning of DSL services (a notoriously messy process). While some argue that utility customers are different, our research shows that the majority of energy consumers would now prefer to interact using digital channels for seven of nine primary interactions (Figure 2). Our analysis also shows that 70 percent prefer self-service interactions overall, yet utilities, on average, only achieve 30 percent self-service thereby wasting valuable operations and maintenance spend and negatively impacting customer satisfaction.

Wireless companies use mobile applications and text messages extensively to notify customers of usage limits and to confirm provisioning of orders, while cable companies use them to manage services, account preferences, and even to program a DVR.

Comparing utility cost structures to other industries, a utility using digital more pervasively could reduce the cost of customer contacts and inquiries by as much as 50 percent. Our experience in other industries also suggests that this will increase customer satisfaction by up to 20 percent. In fact, increasing (well designed) digital interaction and reducing phone-based interaction consistently drives improvements in customer satisfaction and loyalty, as customers have little desire to speak to their utilities.

To accomplish this, strong capabilities in integrated multichannel management with web, mobile, social media and other collaborative tools, as well as strong attention to usability, are critical.

7. Digitally Enabled Products and Services. Digital interactions also help utilities improve consumer engagement and create new opportunities for extending the value proposition.

Companies like Zipcar, Airbnb, and Uber have transformed their industries by making a complex value chain simple with digital business models. Zipcar provides "wheels when you need them" - including taxes, insurance, gas, tolls, and maintenance - at an hourly rate with a few clicks on your smartphone. One mail order prescription drug company morphed, using digital capabilities, from a simple delivery service to one that helps patients be healthier and follow drug regimes more consistently.

Similarly, utilities can use digital capabilities to offer propositions that customers care about - convenience, control, cost, and comfort. For example, our research shows that nearly one third of energy consumers are interested in controlling their home with an 'app' from their energy provider (Figure 3).

Services like the connected home, demand response and energy efficiency programs, integration of distributed generation, and e-vehicle integration provide opportunities for growth and optimization of the distribution system. A number of integrated telecommunications companies already offer connected home services, but none are able to use those capabilities to also optimize energy distribution and use.

8. Digital Enterprise Model. Finally, the need to control general and administrative costs calls for utilities to move to a digitalized enterprise model.

As examples, mining companies are using digital processes to improve people logistics in remote locations, making workers more effective and happier and lowering costs. Oil companies are moving support activities like finance, sourcing, recruiting, and customer service to global 'hubs', enabled by digitally-enabled processes.

Utilities can similarly transform the way enterprise services are provided, such as management of staffing, training, sourcing, finance, and technology services.

Utilities with a digital enterprise model can expect to reduce costs of support services by as much as 30 percent.

Putting it All Together

The business case for utilities to undertake the digital transformation is compelling. In the face of rising costs, new competitors and uncertain growth in demand, utilities need to consider new ways of doing business.

Pursuing digital transformation can be the most effective and cost-efficient way for utilities to address current business challenges and achieve sustainable growth. However, accomplishing such a transformation requires more than the adoption of technologies. Rather, utilities will have to adopt new approaches to dealing with customers and new ways to manage work and optimize the energy value chain. The industry is ripe for this fundamental but much-needed change.

Article image (c) Can Stock Photo