8 Questions

Mackinnon Lawrence is a director in Guidehouse’s global Energy, Sustainability, and Infrastructure practice and the leader of Guidehouse Insights. He is responsible for overall strategy and operations, including management of a global analyst team, development of the Firm’s Energy Cloud thought leadership framework, and client engagements supporting utility, oil & gas, telecom, manufacturing, IT, and consumer tech companies.

Nicholas McClusky is a director with Guidehouse Insights, leading the custom research business. He is responsible for the strategy and operations of the custom research business, providing guidance and implementing best practices on inquiries that fall outside of syndicated research. His focus is on providing actionable insights to clients to help them achieve success.

Bill Hughes is an experienced executive, consultant, and industry analyst leading Guidehouse Insights’ Building Automation and Control solution. He brings over three decades of experience in technology marketing and strategy business planning with expertise in drawing insights from a variety of data sources, building valuation models, and preparing business plans and justifications.

Joe Owens is a research analyst on the Data Insights team at Guidehouse Insights. Prior to joining Guidehouse, Joe’s experience focused on corporate sustainability and ESG initiatives. Through his internships with Coca-Cola's Global Human Rights Team and Inspire Brands’ ESG team, Joe was exposed to a range of ESG issues across the food and beverage space. Through his research, Joe explored the impact of pesticide use on emissions from climate smart agriculture as well as emissions from plastic burning in Guatemalan households. Joe holds a BS in environmental science from Emory University.

Guidehouse's Ninth Annual Pulse Survey of utility executives in North America on the state and future of the power industry, conducted in partnership with Public Utilities Fortnightly, highlights a shift in the industry priorities away from decarbonization toward more resilience-focused investments.

Coinciding with more of a risk-mitigation focus is a willingness among U.S. utilities to lead by example and mobilize innovation in the face of mounting disruptive threats. This includes investing in a more flexible, resilient, and ultimately, more reliable power grid.

At the same time, utilities recognize the importance of balancing competing priorities and are keen to leverage partnerships with regulators as well as state and local governments to capitalize on opportunities within the energy transition. This survey was conducted from March to April 2024, with 405 executives responding.

Addressing competing priorities is a familiar challenge for utilities. Customers demand low-cost, clean, safe, and reliable power. At the same time, energy infrastructure investments require advanced planning with an eye toward a service life extending, in many cases, to 2050 and beyond. All utility initiatives must ultimately align with the endorsement of regulators — many of whom have their own vision around balancing priorities — while also taking into account rapidly shifting public opinion.

Resilience Top of Mind

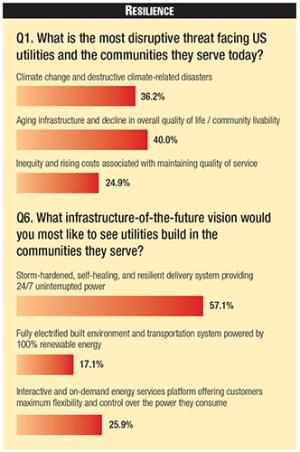

A third of respondents to this year's Pulse Survey point to climate change and destructive climate-related disasters as the most disruptive existential threat to the power industry today, while slightly more (40%) cited aging infrastructure, an overall decline in the quality of life, and community livability as the most pressing concerns today.

Resilience

Resilience

For many communities across the U.S., these two threats go hand in hand, creating urgency for utilities to improve system reliability and deliver 24/7 power to their customers. While just a quarter of respondents cited inequity and rising costs associated with maintaining quality of service, this existential threat saw a ten-point increase from last year's survey, consistent with heightened industry focus on keeping pace with customer demand and preferences.

See Question 1.

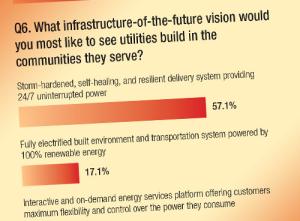

When asked what infrastructure-of-the-future vision utilities should build in the communities they serve, more than half of respondents (57%) pointed to storm-hardened, self-healing, and resilient power delivery providing 24/7 uninterrupted power.

See Question 6.

Flexibility

Flexibility

The responses to both questions underscore the reality that each utility faces a unique mix of existential threats, and therefore, may prioritize different pathways. In all cases, growing challenges to system reliability appear to be pushing to the back burner more aspirational goals like equitable access and decarbonization.

For example, just 17% of respondents would like to see utilities prioritize a fully electrified built environment and transportation system powered by a hundred percent renewable energy in the communities they serve over improved resilience (57%) and greater customer interactivity (26%.) This is a point of departure from past surveys in which we observed a strong consensus around the urgency of decarbonization.

Flexibility Investments Take Center Stage

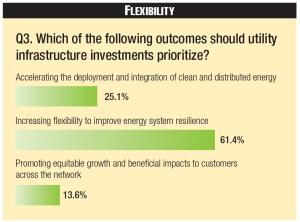

Improving resilience for the power industry requires integrating more flexible generation and digitalization into the system. A majority of pulse survey respondents (61%) share this view, noting that utility investments should prioritize increasing flexibility to improve energy system resilience over accelerating deployment and integration of clean and distributed energy (25%) and promoting equitable growth and beneficial impacts to customers across the network (14%).

See Question 3.

Regulation

Regulation

Improving grid flexibility is a complicated challenge for the power industry, but expanding investments in programs that facilitate collaboration between utilities and their customers, while also leveraging DERs, demonstrate an exciting evolution in solutions that can simultaneously promote all three infrastructure investment outcomes posed to PUF readers: accelerating deployment and integration of clean and distributed energy; increasing flexibility to improve system resilience; and promoting equitable growth and beneficial impacts.

Guidehouse Insights' Energy Transition research underscores the criticality of technology innovation acting as a grid flexibility force multiplier. According to Guidehouse Insights forecasts, at least $1 billion will be invested annually in advanced distribution management systems by 2035 to improve grid reliability in North America.

At the same time, innovations in CE/CX technologies point to a digitally enabled flexibility transformation across the grid edge ecosystem. Investments in behavioral and structural energy efficiency technologies that interact with behind-the-meter technologies like electric vehicles represent an exciting opportunity for utilities to better tailor incentives for their clients. An estimated 90% of North American homes will be served by customer engagement and experience analytics programs by 2030, increasing from around 65% today.

As in previous years, distributed energy resources (DER) continue to attract a growing share of investment across the power industry. Guidehouse Insights analysis forecasts that revenue from DER management technologies in North America will grow to five times current levels by 2030, generating nearly half a billion in annual revenue. DER's exponential growth in recent years and associated intermittency are likely a key contributor to a renewed focus on flexibility and predictability in this year's pulse survey.

Building Regulatory Consensus

Investment

Investment

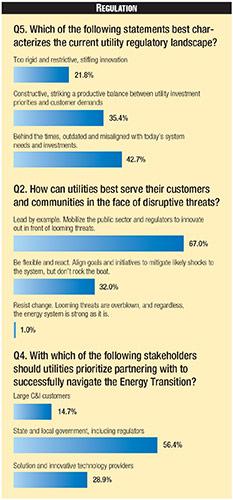

Continuing a clear theme in prior Pulse Surveys, the current regulatory landscape in the U.S. casts a long shadow over the power industry's pursuit of energy transition innovation. As in previous years, most respondents (42%) see the current utility regulatory landscape in North America as behind the times, outdated, and misaligned with today's system needs and investments.

Just under a quarter of survey respondents agreed with the notion that the regulatory landscape is too rigid and restrictive, and stifling of innovation. Just 36% of respondents see the landscape as constructive and striking a productive balance between utility investment priorities and customer demands. While some improvement over previous year's surveys, it's clear that there is still a gap between power industry ambition and regulatory appetite for aggressive innovation.

See Question 5.

Irrespective of whether the regulatory landscape is overly restrictive, misaligned with today's system needs, or just right, utilities are wrestling with whether to proactively innovate out ahead of disruptive threats or invest precious time and capital into cultivating critical partnerships. Not surprisingly, nearly all respondents (99%) rejected the notion that utilities should resist change and bury their heads in the sand in the face of disruptive threats.

See Question 2.

Meanwhile, most of the respondents (67%) embraced a more proactive approach in which utilities lead by example to mobilize the public sector and regulators to innovate out ahead of threats. This is an encouraging trend and shows a willingness among utilities to be out in front of looming threats to the status quo as opposed to taking a more reactive approach, a view shared by less than a quarter (22%) of survey respondents.

It is increasingly clear that in spite of a complex regulatory environment, utilities are eager to act on multiple fronts to achieve their mission of improving resilience and better serving their customers. A growing backlog of desirable projects offers demonstrable value to the grid, and ultimately, to utility customers.

Utilities must work constructively with a variety of stakeholders to realize their goals. When asked which stakeholders should utilities prioritize partnering with to successfully navigate the energy transition, more than half (56%) pointed to state and local governments, including regulators.

See Question 4.

It's worth keeping an eye on whether this portends a shift in sentiment away from investing aggressively in solution and innovative technology providers (29%), which has been a clear theme in past surveys consistent with a surge of investment into emerging companies by utilities over the past decade.

Somewhat surprisingly, only 15% of respondents pointed to large commercial and industrial (C&I) customers as key partners in navigating the energy transition. This is counterintuitive given the importance of these customers to the utility bottom line, as well as their increasing focus on decarbonization. Utilities will need to remain close with these anchor C&I customers, especially among industrial, technology, and data center end-consumers, which enjoy an expanding portfolio of options and incentives to invest in clean onsite power generation across their facilities.

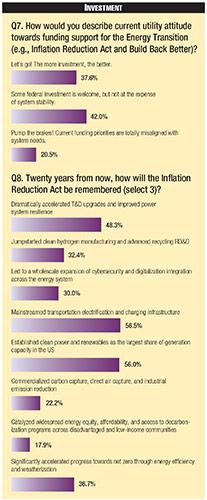

Bullish on Federal Investment Programs

Nearly 80% of survey respondents expressed general support for energy transition funding programs, including the Inflation Reduction Act and Build Back Better. Within this group, there was an even split between those who would like to see even more investment and those who were open to additional dollars, so long as system reliability could be maintained. Just one-fifth of respondents felt investment should be reduced and better aligned with system needs.

See Question 7.

When asked how the Inflation Reduction Act (IRA) would be remembered in twenty years, respondents saw a mainstreaming of transportation electrification and charging infrastructure (56%), expanding clean power and renewables as the largest share of generation capacity in the U.S. (56%), and accelerated T&D upgrades and improved power system reliance (48%) as the most likely scenarios.

With nearly $370 billion allocated toward building a clean energy economy under IRA, progress toward net zero (37%), jumpstarting clean hydrogen (32%), and an expansion of cybersecurity and digitalization across the energy system (30%) were also seen as likely beneficiaries, although to a lesser degree.

Meanwhile, carbon capture and sequestration (22%) and equity and energy affordability (19%) garnered the least number of votes in spite of the IRA's stated goal of accelerating climate change solutions and improving energy access across the U.S.

See Question 8.

The Ninth Annual Pulse Survey highlights that over the length of the study, many past themes remain true to this day. The power industry is consistently optimistic about transportation and building electrification opportunities but demonstrates a consistent bias in favor of grid reliability and T&D investments.

The regulatory landscape continues to play the spoiler, frustrating more ambitious energy transition initiatives. There remains widespread consensus that innovation and investment are critical to the industry's future. At the same time, the industry remains committed to balancing progress with system reliability.

What has shifted over the past decade is a significant focus on managing expanding clean, renewable, and distributed power towards resilience above all else. Given the rising tide of existential threats, this comes as no surprise for a power industry that finds itself, on one hand, awash in exciting innovation, and on the other, facing a new era of daunting operational complexity.