A network of networks – in search of an orchestrator.

Jan Vrins heads Navigant’s Global Energy Practice. Also working in the Navigant’s Energy Practice are Hector Artze, managing director, and Richard Shandross (associate director), who works also in Navigant’s Energy Efficiency Policy and Analysis Group. Mackinnon Lawrence (research director) leads the Energy Technologies and Utility Transformation programs at Navigant Research. The authors thank Dan Bradley, Anissa Dehamna, Ken Horne, and Eric Woods for contributing to this article.

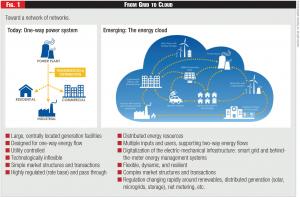

The power sector is transforming. It's changing from a centralized, one-way hub-and-spoke grid - based on large centralized generation assets like fossil fuel, hydro, or nuclear power plants - toward a more decentralized grid, with an increased role for renewables and distributed energy resources (DERs).

We call this new grid the Energy Cloud.1

This shift encompasses technologies and solutions like integrated demand-side management (iDSM), microgrids, virtual power plants (VPPs), storage, electric vehicles (EVs), and others. It also includes advanced software and hardware to enable greater control and interoperability across grid elements. These changes will necessitate new business models, new players, adapted regulations, and new ways of financing, building, maintaining, and operating the grid.

The Energy Cloud will change the way we generate, store, and consume energy. It marks a change from a one-way power flow to a dynamic network of networks supporting two-way energy and information flows.

We need only quote the current U.S. Secretary of Energy, Dr. Ernest Moniz, to verify what's happening: "I believe we are actually in the revolution...right now."2

Figure 1 - From Grid to Cloud

Figure 1 - From Grid to Cloud

Consider these tipping points and what they mean for the future:

- Distributed Generation. Annual installations of new distributed generation capacity are projected to surpass new centralized generation by 2018, both in the U.S. and in many other countries.

- Gas-Fired Generation. U.S. generation of electricity fueled by natural gas exceeded coal-fired generation in April 2015 - for the first time since EIA began collecting monthly generation data in 1973.

- Solar PV. The installed cost of distributed solar capacity is projected to fall below $3/Watt for residential photoelectric capacity, and below $2/Watt for commercial PV by 2020 (if not sooner).

- Utility-Scale Solar. Utility-scale installed solar energy production has fallen in cost to levels less than $40/MWh in U.S., and is expected to come in around $10-20/MWh within the next 3-5 years.

- Storage. Investments in storage are projected to exceed $13 billion by 2020.3 Tesla's announcement of its home and business storage solutions will give home and commercial storage a big push, further accelerated by key partnerships with utilities (Enel) and other DG vendors (SolarCity).

- Renewables. Spurred by carbon regulations in Europe and the U.S. (proposed), investment is shifting toward carbon-efficient resources such as renewables, as well as energy efficiency.

- California & New York. Regulatory reforms underway in California (e.g., Assembly Bills 327 & 2514, and Rule 21), and New York (Reforming the Energy Vision or "REV") are driving transformation.

- Microgrids. Weather-related outages have prompted various states (New Jersey, New York, Connecticut) to boost resiliency by adopting policies that to support distributed resources, including microgrids.

The Energy Cloud will likely prove much more dynamic than the traditional power grid. It will introduce new regulations, actors, and business models to a sector that, until recently, has not changed its fundamental structure in more than a century. In this article, we discuss a new role that will likely appear as the Energy Cloud evolves. We call this new role the "network orchestrator." Judging from the past, this new role may well create a new business model for the utility industry.

The Network Orchestrator

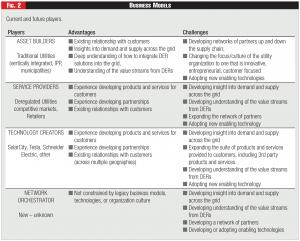

According to Barry Libert, Yoram (Jerry) Wind, and Megan Beck Fenley from the University of Pennsylvania's Wharton School, every company uses one or more of four basic business models: 1) asset builder, 2) service provider, 3) technology creator, and 4) network orchestrator.4

"Asset Builder" marks the traditional and predominant business model across the utility industry since its inception. Then, when efforts to deregulate the utility industry took shape in the United States and Europe in the 1990s, a new business model emerged: "Service Provider." This second model, separate from the first, aimed to introduce competition, improve customer service, and lower the cost of power to consumers.

Figure 2 - Business Models

Figure 2 - Business Models

More recently, the rate of technology innovation has accelerated across the industry, allowing many technology creators to enter the utility sector. Coupled with the expansion of distributed resources and smart grid infrastructure now capable of generating and harnessing an ever-increasing volume of data, technology creators are positioning themselves to capitalize on new ways to produce, distribute, and use electricity.

The fourth business model - that of "Network Orchestrator" - is yet again different. Potentially the most profitable of the four business models, the network orchestrator role will capture value by tailoring electricity supply and demand services for a customer, utility, or grid operator.

The emergence of the Energy Cloud means that anyone, anywhere can sell energy services into an open market, typically on a forward-looking basis. If these committed resources fall short, or if the situation changes, another market can allow for spot purchases to fill in the gaps or make corrections. The network orchestrator aggregates and coordinates these supplies and services.

As has been observed with social media and other networked products, the value of the system increases more than proportionally to the number of participants.5 Network orchestrator business models in other industries, such as the internet, have proven able to achieve faster growth, larger profit margins, and higher valuations relative to revenue. Libert et al. cite a number of examples, including Airbnb.com, WhatsApp, Uber, and Alibaba.

To date, however, we have not seen network orchestrators at scale within the electric utility industry. In some cases, one could argue, utilities and independent system operators - commonly working at the transmission level and less often at the distribution level - are beginning to perform these functions. Because companies employing the network orchestrator business model outperform other types of companies on several key dimensions, it may be a matter of time before pure network orchestrators emerge and establish themselves as key orchestrators within the Energy Cloud.

Venues for Orchestrators

We see no clear contenders at this point for the role of network orchestrator in the utility industry. But we should note that rarely in other industries has an existing player made the leap. As in other industries, we strongly believe that new players will enter the field to become the network orchestrators of the utility industry.

That said, however, we wonder if events in our industry might well play out differently than seen elsewhere.

For example, we see many utilities evaluating and making the initial investment in network orchestrator roles in areas like virtual power plants, building energy management, microgrids, storage, and others. We also see some technology creators partnering with service providers, like Solar City and Nest partnering with retailers, and see them potentially transitioning fully into network orchestrators. Below we describe some examples of network orchestrator roles appearing across a broad set of new businesses and technologies in different geographies.

Microgrids & DSOs. Through its initiative known as "Reforming the Energy Vision," or REV for short, New York is implementing regulatory changes to promote deeper penetrations of distributed energy resources, including renewables such as wind and solar. As part of this reform, New York will allow utilities as well as third parties to perform the new role of Distributed System Operator, a type of network orchestrator. The DSO will make investments, conduct market operations (through facilitation of DERs), and finally conduct physical operations that involve real and reactive power flows, outage restoration, switching, reliability coordination, and situational awareness.

The emergence of microgrids offers another opportunity for the would-be network orchestrator.

A microgrid6 is typically composed of a diverse set of DER and demand response (DR) resources, thus requiring coordination, scheduling, balancing, etc. They are sometimes grid-tied as well (and often, in the case of New York), so as to respond to issues concerning resiliency in the larger energy network.

The role of a potential network orchestrator in a microgrid setup is more limited than it would be in a traditional power grid. However, microgrids offer numerous opportunities for network orchestrators.

One example of an emerging business model comes from the Microgrid Resources Coalition, which has proposed a new category of microgrid participant, known as the microgrid "organizer" (a clearly identified network orchestrator role), which it hopes will eliminate complexities and confusion in regulating multi-customer microgrids. The Coalition is working with the Federal Energy Regulatory Commission (FERC) to help monetize value streams from the distributed energy resources that are typically incorporated into microgrids. While most of the action in support of multi-customer microgrids is happening at the state level, such as in New York and Connecticut, FERC can play a role in setting the stage for the network orchestrator model. If its track record on DR and energy storage is any indication, its role in creating a more level playing field for innovation in the Energy Cloud could be significant.

Virtual Power Plants. The term "VPP" denotes a system of distributed resources that is integrated to allow it to provide a reliable overall power supply. VPPs accomplish this by coordinating technologies such as solar photovoltaic (PV) systems, advanced batteries, and EVs. From the outside, the VPP looks like a single power production facility that publishes one schedule of operation and can be optimized from a single remote site. From the inside, the VPP can combine a rich diversity of independent resources into a network via sophisticated planning, scheduling, and bidding of DER-based services. VPPs can leverage supplies from existing generators, utility DR programs, and other forms of distributed resources without any large-scale fundamental infrastructure upgrades.

The VPP concept is a natural venue for a network orchestrator. A good example of a VPP acting as a network orchestrator is Flexitricity, a participant in National Grid UK's Demand Side Balancing Reserve (DSBR) program.

Flexitricity coordinates a varied mix of capacity drawn from end users and small generators, making it available as aggregated reserve to National Grid as needed. Their platform, which they call a smart grid, allows customers to maintain control of their assets. Without such an aggregation platform, these small entities could not participate in the DSBR program and National Grid could not make use of their capacity.

Energy Storage. With the mandatory targets now in place in California, we see significant attention to energy storage as an asset that can add both flexibility and reliability to an electric system - whether that system is the grid, a microgrid, a VPP, or a building. But the linchpin is not the battery, but rather the software and controls that comprise the intelligence of the system. The network orchestrator function thus marks a natural evolution within the energy storage sector.

Through partnerships and supply agreements with major Asian lithium ion (Li-ion) battery manufacturers and subsidies in anchor markets such as California, distributed energy storage developers have managed to reap the benefits of falling battery prices while scaling their operations. Developers are using a number of different models to capture market share including leasing, shared savings, and system sales. The market has responded favorably to all three models.

Ultimately, distributed energy storage developers such as Stem, Green Charge Networks, Coda, Tesla, and Sharp are eyeing storage-enabled VPP markets as the natural progression of their business models. Currently, the main barrier to this model is local market structures. However, once these aggregation-based markets are unlocked, the compatibility between platforms will become a critical issue. Many developers are already in the process of creating the requisite software to aggregate systems and deliver services to utilities as well as to domestic or non-domestic customers. Some vendors may choose to license or open-source their platforms in order to gain market share while others may choose to keep their platforms proprietary.

Smart Cities. Cities serve as prime examples of the complex interdependencies associated with the Energy Cloud and, as a result, they offer various opportunities are presenting themselves for network orchestrator-type roles. Such opportunities can be seen as a form of community- or urban-scale VPP. In the early trials of such schemes, the orchestrator role is typically assumed by the local utility and/or a demand aggregator. Technology providers have also played a key role in providing coordinating platforms and energy management solutions.

The technical and market challenges to delivering such systems at a city scale are significant, however. As in other areas, it is still not clear which stakeholders are in the best position to play the orchestrator role. Today, most cities look to their utilities to lead the transformation of their energy systems - in the future, however, they may look to other agencies and partners to assume a leadership role. One possible solution would be a new joint venture between a municipality, one or more utilities, and a platform operator, but other models are certainly possible.

Early pilots - e.g., the German E-Energy pilots - show us that challenges exist in delivering these systems, such as consumer acceptance, the complexities of the market mechanisms involved, and technical integration requirements. However, ambitious projects continue to be launched with the goal of finding technical and market models that can scale to larger communities.

The PowerMatching City pilot in the Netherlands, for example, is examining how a dynamic, local energy network might work in practice. The Yokohama Smart City Project in Japan is a large-scale pilot project focused on energy management at the household, district, and city level.

Transactive Players

By its very nature, transactive energy requires entities to assume the role of network orchestrator. The GridWise Architecture Council defines transactive energy as: "techniques for managing the generation, consumption or flow of electric power within an electric power system through the use of economic or market based constructs while considering grid reliability constraints."7

For our purposes, we can identify at least two types of players in transactive energy that could adopt the network orchestrator business model: a) providers of a platform for conducting transactions and b) those who employ such a platform to realize the transactive market.

In the usual case platform providers are focused primarily on the supply of necessary software and/or hardware. Yet, by participating significantly in platform administration, they could assume a network orchestrator role. Alternatively, the platform provider might choose to focus on platform development and deployment exclusively, leaving network administration to a dedicated intermediary party, in a manner analogous to OpenADR, a standard for automating demand response.

Transactional networks offer opportunities for the network orchestrator role that extend beyond traditional generation and/or delivery. For example, a growing number of smart grid vendors now offer asset performance software for managing assets and operations, and smart grid analytics are now available through a cloud-based software-as-a-service platform. Also, the DOE is funding research into related transactional networks that can extend transactive energy in a granular way into smart buildings - and even to their individual energy-consuming components.

Nevertheless, equipment- and building-based transactional capabilities in many cases will not deliver the level of marginal savings (or revenue) necessary to motivate the customer purchase of super-smart enabling components or systems. That said, devices, equipment, and materials that are enabled for the Internet of Things will form a ready substrate for a successful, low-cost transactive energy overlay by well-conceived and well-positioned network orchestrators.

Movement in this direction is underway with the development of smart appliance platforms such as SmartThings by Samsung and Whirlpool's 6th Sense. Whether the large appliance companies can make a shift to operating a cross-cutting smart building transactional platform remains to be seen. It will not surprise us to learn that the future Energy Cloud's version of eBay is being coded in a college dorm room as we write this article.

Technology Upstarts

Technology creator companies such as SolarCity, Tesla, and Schneider Electric may hold some interest in becoming network orchestrators, but they will need to transform the way they do business. They will have to go beyond the development and marketing of their own products and services to become a channel to a wide range of products and services.

Technology creator companies could follow the model developed by Amazon. At first, Amazon used its e-commerce technology only to sell products. Later, however, Amazon evolved to become a network orchestrator - opening its technology platform to 3rd party vendors who leverage it to sell their own products.

Some technology creator companies working in the Energy Cloud today already offer financing, or serve as integrators, or provide operations and maintenance services. To fully support the role of the network orchestrator, however, they will have to expand their capabilities by partnering with the grid owners and operators to address the challenges and opportunities associated with the grid integration or distributed resources.

Opportunities for Utilities

For traditional utilities, including both the asset operators and the service providers, the journey to network orchestrator will not be easy. The move will require utilities to transform the focus of their business, adopt new technologies, and even more importantly, to change their organization and culture. Yet the journey is one that utilities must make if they wish to remain successful.

One path for utilities might lie in creating new business models that depend less on volume and throughput, and more on building network platforms. On the plus side, utilities hold several advantages in this area, including an existing relationship with their customers, insights into demand and supply, and a deep understanding of how to integrate distributed resources across the grid.

To date we have not yet seen a wide-scale emergence of network orchestrators in the utility industry. Yet it could happen in the very near future. Will orchestrators resemble what we've seen in other industries? We will have to wait and see.

And yet we know that while the utility industry is not going away (fears of a death spiral notwithstanding!) utilities will have to rise to the challenge and transform their business.

Endnotes:

1. Lawrence, Mackinnon and Woods, Eric. The Energy Cloud. Navigant Research, April 2015.

2. http://thedailyshow.cc.com/extended-interviews/to626x/exclusive-ernest-m... beginning at 10:00 minutes.

3. Storage will be a game changer, with investments in storage projected to exceed $13 billion by 2020. Dehamna, Anissa. Energy Storage Enabling Technologies. Navigant Research. March 2015.

4. Libert, Barry, Wind, Yoram (Jerry), and Fenley, Megan Beck, "What Airbnb, Uber, and Alibaba Have in Common," Harvard Business Review, November 20, 2014.

5. Metcalfe's law on the value of (communication) networks

6. The U.S. Department of Energy (DOE) defines microgrids as "localized grids that can disconnect from the traditional grid to operate autonomously and help mitigate grid disturbances to strengthen grid resilience." See http://energy.gov/oe/services/technology-development/smart-grid/role-mic....

7. See, for example, the GridWise Architecture Council's resources on TE at: http://www.gridwiseac.org/.

Lead image © Can Stock Photo Inc. / ponomarenko13