Great Britain’s latest innovation in grid regulation.

Peter Fox-Penner is chairman of The Brattle Group. Dan Harris is a principal in Italy, and Serena Hesmondhalgh is a principal in the U.K. The authors acknowledge the contributions of Paul Whitaker of National Grid, Chris Watts of Ofgem, and Heidi Bishop of The Brattle Group. The opinions expressed in this article are solely the authors’.

The electric industry has entered an era of low-to-negative sales growth alongside high, policy-driven investment needs. This era will call for significant network reinforcement, as generation resources become more diverse, including demand response. Grid operators will need smart grid innovations to manage price-responsive loads and even the interconnection of electric vehicles. Directly or indirectly, this squeeze will touch all segments of the industry, including distribution and transmission owner-operators. Grid owner-operators are particularly affected, as a very high proportion of their costs are fixed. They remain price- or revenue-regulated (or publicly owned), but yet often are given responsibility for delivering on policy outcomes such as greater energy efficiency or green power use.

Recognizing this situation, the electric and gas regulator of Great Britain (GB), Ofgem, has launched a new approach to electric and gas network regulation known as RIIO. No, it’s not the location of the 2016 Olympics. Rather, the acronym stands for “Revenue = Incentives + Innovation + Outputs.” Less formally, it’s an ambitious experiment in performance-based regulation (PBR), with elements resembling a host of regulatory practices in Europe and the U.S. It could be labeled a “performance-based revenue cap with decoupling.” Under the RIIO framework, Ofgem plans to transition to a low-carbon economy so as to better deliver value to energy consumers over the longer term.

While it’s too early to tell precisely how successful RIIO will be, its emergence clearly signals that regulation of our gas and electric networks has become far more complex, multi-faceted, and critical to the achievement of energy policy goals than ever before. We might not be able forecast its impact, but it’s clear that this effort is a step in the right direction.

A Three-Pronged Framework

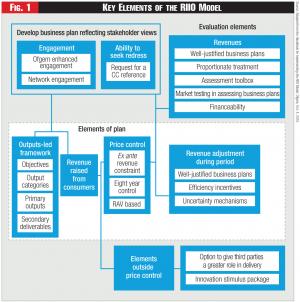

The core of the RIIO approach is a kind of business plan that each of the U.K.’s 14 distribution energy network operators (DNOs) and three transmission system operators must submit to the United Kingdom’s independent regulator, Ofgem. The overall purpose of the plan leads to a set of license amendments that amount to regulatory approval of three sets of financial controls:

Figure 1 - Key Elements of the RIIO Model

Figure 1 - Key Elements of the RIIO Model

• First, a set of performance (output) metrics the DNOs agree to meet, with financial incentives and penalties for under- or over-performance on many of them;

• Second, an allowed revenue requirement over the eight years of the “price control”;

• Third, a series of mechanisms for addressing uncertainty in the plan, including what U.S. regulatory practitioners would call “reopeners.”

Understand, however, that many of RIIO’s most critical dimensions of business model change aren’t yet specified. Instead, each DNO’s current pricing policies will remain in place until the DNO requests approval for changes from Ofgem. Since none of the DNOs have yet made it through a full RIIO cycle, the degree to which RIIO will lead to a reformation of the key customer relationship and pricing dimensions of the utility business model remains to be seen. It’s also worth noting that these “wires-only” entities have had revenue decoupling built-in for many years, even under the predecessor approach, RPI-X price cap regulation.

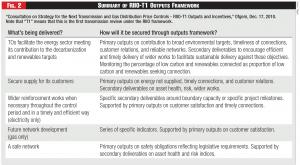

Figure 2 - Summary of RIIO-T1 Outputs Framework

Figure 2 - Summary of RIIO-T1 Outputs Framework

The heart of the RIIO approach consists of the filing made by the DNO. Though referred to as a business plan, it’s really a massive regulatory filing and financial modeling effort. Plans typically reach into many hundreds of pages, with detailed cost, budget, and process information. In addition, plans must document how the DNO has consulted with stakeholders, and how it proposes to manage uncertainty, demonstrate cost efficiency, and meet other requirements. As Ofgem noted to us, the required degree of cost justification is proportionate to the level of costs involved.

Figure 1 shows the main elements of the RIIO process. The progression starts at upper left with stakeholder consultation, which leads to the business plan. The plan’s two key elements are the extensive set of outputs that are promised and the associated allowed revenues. The revenues are evaluated from several standpoints, as shown at the upper right, with distinctly British titles. For example, “well-justified plans” means that the DNO has provided models, data, and backup information that have convinced Ofgem that the revenue forecasts are reasonable in the context of the outputs that the company is committing to deliver to customers.

Along with the projection of base revenues, the plan must either acknowledge that Ofgem’s proposed mechanisms to manage uncertainty over the eight years are appropriate, or else provide evidence to justify why additional revenue adjustment mechanisms will be needed. Similarly, the plan must provide strong justification for any changes from the output incentives put forward by Ofgem and reasons for any additional incentives the DNO believes are required. These mechanisms are intended to provide incentives and penalties for performance above or below the base output target and also to cope with uncertainty.

Lastly, the regulatory approvals for some innovative activities and some third-party options will occur outside the revenue requirement, as they’re thought to be too difficult to predict far in advance. Yet the DNOs are still expected to properly consider alternative techniques throughout their plans and some innovative techniques could therefore sit within their base funding.

The desired – and sometimes required – outputs vary by type of network operator and are developed in separate generic consultation. These output requirements aren’t for the faint of heart. Figure 2, extracted from an Ofgem consultation, shows that for transmission network owners (TOs) there are five broad categories, each with multiple, more specific primary and secondary outputs.

In this example, the business plan of each transmission licensee must explain in detail the list of metrics it will use for each output, the minimum or baseline level for the metric, the target level, and the proposed incentive and penalty mechanism for achieving it.

The financial part of the plan provides detail on how much the achievement of these outputs is going to cost. Of course, to answer this the plan must provide all financial assumptions underpinning the revenue requirement, including budgets and costs, the proposed capital structure, the assumed costs of equity and debt, the eight-year financing plan, and other information. The ultimate filing is massive and comprehensive; for instance, National Grid’s initial filing under RIIO ran to 1,044 pages.1

Processing the Plan

The U.K. doesn’t employ adversarial courtroom-style regulatory proceedings, so the process of getting a RIIO plan adopted resembles the sort of negotiated, stakeholder-driven multi-party deal that’s increasingly the norm in the U.S. However, that doesn’t mean the process is particularly easy or fast. The main steps in adopting a RIIO plan are:

1. Companies submit a draft business plan after their own process of stakeholder engagement and formulation;

2. Ofgem posts the draft plans and solicits comments;

3. Ofgem performs its own analysis of the business plans, including its own internal financial modeling;

4. Ofgem publishes its own initial assessment of the plans including the assessment of which companies are eligible for fast-tracking and, if so, its initial determination for fast-track companies.2 This step also highlights weaknesses of any plan not eligible for fast-tracking;

5. Slow-track companies revise and resubmit business plans;

6. Ofgem publishes final determination for fast-track companies;

7. Ofgem publishes its initial determination for slow-track companies;

8. Ofgem publishes final determination for slow-track companies;

9. Ofgem consults on the required license amendments;

10. Ofgem implements the license amendments.

Companies forced into the slow track are subject to Ofgem’s assessment of appropriate expenditures, even if they’re significantly different from their plans. Under fast-tracking, Ofgem accepts the companies’ plans broadly “as is.” Although Ofgem gives itself a fast-track option, it estimates that the normal process takes about 30 months. Thus, at the start of the process a DNO is forecasting costs nearly 11 years into the future – a daunting challenge for any regulated company. Final license amendments, if rejected by the DNO, can be referred to the Competition Commission – analogous to FERC decisions being appealed in federal court.

Due process tends to be simpler, in practice. The agreement is a set of license amendments, which can be appealed to the Competition Commission. Third parties making this claim must bear the cost of the appeal themselves. They must be able to prove, first to Ofgem’s satisfaction, that they were engaged stakeholders during the price control review process. Overall, the appeal should take no longer than 30 weeks.

Operating Under RIIO

Once the license amendments come into force, the real work begins. Ofgem requires extensive data reporting, some quite specific to particular pledged outputs. Annual reports are required, along with detailed reporting on outputs.

For the reliability output for transmission owners, Ofgem measures “Energy Not Supplied” (ENS), with specified exclusions for events, such as outages requested by the system operator. In addition, it proposes to measure average circuit reliability, an index of asset health and failure risk, and the number of faults and failures. To measure the customer satisfaction output, information is gathered from customer surveys, evaluations of stakeholder engagement by an expert panel, and its own monitoring of complaints.

Many of these outputs are subject to pre-set incentive and penalty mechanisms for exceeding or missing target outputs. In the transmission owner’s customer satisfaction output, Ofgem proposed to add or subtract a maximum of 0.5 percent of revenues based on a customer satisfaction scoring system developed by Ofgem. Another 0.5 percent more or less can be awarded on a proportionate scale by the stakeholder engagement evaluation panel.

Each price control also has a series of adjustment mechanisms with pre-specified triggers. Some of the triggers are for cost drivers that far exceed the levels projected in the plan. For example, if the number of electric vehicles purchased in year 5 of the period vastly exceeds the level forecasted in the plans, the revenue requirement can be adjusted through a formula that stakeholders agree will provide reasonable but not excessive cost compensation. Electric distribution companies also have reopeners for other load-related expenditures.

Another important category of reopener is the “uncertainty mechanisms.” Uncertainty mechanisms function much like the adjustment mechanisms, but are targeted at system planning or cost changes that are difficult to predict or reduce to a formula. For example, if the predicted number of large-scale renewable generators needing transmission doesn’t materialize, or are located far differently than predicted, the cost impacts are largely impossible to reduce to an ex-ante adjustment formula. Changes like this would lead to a consultation with Ofgem and stakeholders and a subsequent revenue adjustment.

A Settlement, Essentially

Standing back and taking a deep breath, one can see that RIIO is a giant negotiated performance-based contract, or what we in the U.S. might call a settlement. “It’s not a formula,” Ofgem’s Chris Watts said when we discussed RIIO at length, “it’s a regulatory contract.”

On the PBR family tree, RIIO is clearly the successor to the UK’s use of RPI-X revenue cap regulation. Ofgem chose to keep the core idea of revenue-cap regulation, which is to set allowed revenues (ergo, prices) for a prolonged period and let the regulated company keep the profits if it can deliver the same outputs but lower its costs through genuine efficiency improvements.

Nevertheless, RIIO makes several very fundamental changes to the old approach. First, rather than set allowed revenues for operating and capital outlays separately, RIIO combines the two into totex (total expenditures). This approach reflects a view by Ofgem that opex and capex incentives were so different under RPI-X that some companies shifted costs between operating and capital accounts in an inefficient manner. Ongoing disputes over capital spending under the RPI-X approach were quite frequent, although Ofgem’s view generally was accepted by companies in the end.

Second, RIIO extends the price control period even longer than the former five-year RPI-X price control interval. The longer period was intended to highlight the long-term nature of the transition to a low-carbon economy. It reflects the fact that distribution and transmission equipment last for many decades, and that network building and maintenance cycles can easily run into the decades. Of course, the longer control period comes with its own tradeoffs and risks.

The third major change in RIIO is its very strong focus on multi-faceted outputs, each measured with great effort and often incentivized formulaically. The regulatory contract is for an exceedingly well-specified bundle of outputs, well befitting an era in which energy networks contribute to a wide variety of economic and social objectives.

But Will it Work?

It will be many years before we can gauge how well RIIO is perceived to have worked and perhaps much longer before objective comparisons to alternatives can be made. Nonetheless, we suspect that the RIIO’s ultimate success will hinge on a handful of issues that could start to shed some light on its potential sooner rather than later.

First and foremost: does RIIO strike the right balance between setting revenue requirements eight years in advance and allowing reopeners to address unforeseen outcomes? If energy network costs are sufficiently unstable in this era of rapid change, there will be repeated and perhaps even pancaked invocations of the reopeners. It might also prove difficult to determine the cause of certain cost shifts; huge sums of money can hang in the balance between management imprudence and force majeure. This weakness could greatly burden Ofgem, the DNOs, and especially third-party stakeholders, who typically have fewer resources to devote to the regulatory process.

Another pivotal test for RIIO will lie in its ability to model costs reasonably well in attribute bundles that are somewhere near the social optimum. The DNOs are submitting very extensive cost models, and Ofgem has done extensive modeling on its own, including utilizing teams of outside experts. To be fair, this problem affects all forms of regulation to varying degrees. It might or might not be exacerbated here by the extremely long commitment period and the complexity of output bundles, whose costs are undoubtedly non-separable or joint.

It’s difficult to tell whether the formulaic incentives and penalties will work to bring the networks closer to the social optimum. Valuing social benefits sensibly is the key. For that to occur, the cost of efforts required to increase an output, or the savings reaped by reducing it, must run well below the incentive and penalties, respectively. Yet it’s always notoriously difficult to determine the marginal costs or savings that come from additional management focus or internal process improvements, versus other factors that can lead to performance changes.

Finally, the sheer volume and complexity of the undertaking remains worrisome. In particular, consider the series of consultations, workshops, and stakeholder processes associated with a RIIO determination. If the regulatory resources within companies, stakeholders, and Ofgem are worn thin, the process won’t work well even if it’s well-targeted and well-intentioned.

All the same, there’s much value in the new direction in which RIIO is steering regulation. By focusing DNOs and the public very openly on the various responsibilities (i.e., outputs) we are placing on energy networks, Ofgem is encouraging a healthy public dialogue on tradeoffs between the policy obligations of these networks and the overall costs of service. If we want faster hookups of distributed generators, universal access, extension of the grid to large new renewable plants, pilots of new low-carbon solutions, management of energy efficiency programs, and adequate reliability and cyber security levels, we have to gain a sense of how much of each we want and what it will cost. In the best of all worlds, RIIO will allow Ofgem and the DNOs to agree on the minimum level of performance in all these areas and how much to pay for higher levels of each output above the floor.

Regulators in both the U.K. and the U.S. face the same unsolvable incentive dilemma. Formulaic PBR mechanisms are usually transparent in their incentives and administratively simple, but they’re only efficient if they deal with future technical change and other difficult-to-predict events. Contemporaneous oversight can be more accurate, but any such oversight process is prone to over- or under-adjustments due to political forces or simple process errors.

RIIO’s unusually long planning period, along with its many moving parts, makes it especially difficult to predict whether it’s found the right combination between formula and intervention. Only time will tell. For now, however, we don’t think any regulatory scheme in the world better reflects the essential and highly complex role of energy distribution networks in the emerging low-carbon economy.

Endnotes:

1. “Response to Ofgem RIIO December Consultation,” National Grid, Feb. 4, 2011.

2. As its name suggests, “Fast-Tracking” is an expedited approval process that Ofgem can elect at is discretion if it determines that an Application meets high standards as initially presented.