Energy Reform: A Legislative Washout?

Congress is shifting U.S. energy policies toward green alternatives. Is the new direction temporary or permanent?

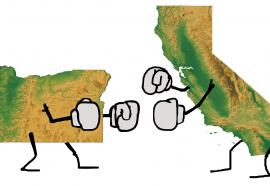

Fundamental questions about fuel supply, efficiency standards, and environmental performance have splintered Republicans and Democrats into warring factions. As a result, the only proposals legislators can agree upon seem to be watered down half-measures.