Eight Questions

Mackinnon Lawrence is a director in Guidehouse's global Energy, Sustainability, and Infrastructure practice and the leader of Guidehouse Insights. He is responsible for overall strategy and operations, including management of a global analyst team, development of the Firm’s Energy Cloud thought leadership framework, and client engagements supporting utility, oil & gas, telecom, manufacturing, IT, and consumer tech companies. His expertise covers energy transformation, business model innovation, and technology disruption.

Jessie Mehrhoff is a research analyst contributing to Guidehouse Insights’ Virtual Power Plants solution. Mehrhoff’s work focuses on demand response, utility customer value-added solutions, and DER integration strategies.

In its fifth consecutive year, Guidehouse, formerly Navigant, and Public Utilities Fortnightly's annual pulse of the industry survey captured the power sector's view on disruptive forces shaping the future of energy. Responses from utilities, regulatory commissions, manufacturers, and service providers indicate a continued, strong understanding that the utility industry is in the midst of significant transformation. As the industry evolves toward a more distributed, clean, mobile, and intelligent energy future, the survey shows that business model evolution, distributed energy resources integration, and climate change are top of mind for all industry stakeholders as both existing and new challenges accelerate unprecedented change.

Note that this survey took place right before the COVID-19 crisis hit us, and the impacts of this crisis were not surveyed.

Clean Power, DER Continue to Disrupt Utility Business Model

Survey respondents acknowledge that the growth of both clean energy and DER are having a demonstrable impact on the utility business model, and will for the foreseeable future. Aligning with last year's response, nearly two-thirds or 62 percent, of respondents in 2020 stated that rapidly increasing renewables and DER are the most disruptive force to the utility business model.

This response is consistent with observed trends across the industry. Record generation from wind and near-record generation from solar in 2019 led to clean energy resources supplying more electricity in the U.S. than coal for the first time ever according to the Energy Information Administration.

Meanwhile, new global DER capacity deployments continue to outpace new centralized generation capacity. According to analysis by Guidehouse Insights, annual net new DER installed capacity - including fast-growing segments like distributed renewables, electric vehicle charging, and demand side management - is expected to grow to more than a hundred and ninety-five gigawatts in 2020 and to more than five hundred gigawatts by 2030.

Figure 1 - Disruptions

Figure 1 - Disruptions

As digitization of the power grid continues, new advanced software and hardware that allow for greater control and interoperability are enabling the proliferation of DER. For example, utilities and other grid operators and energy providers are using DER management systems to accomplish various goals such as resource adequacy, economic optimization, and grid services depending on the type of energy provider and the regulatory and market environments in which they operate.

DER management systems and advanced distribution management system related-investment in North America is expected to reach one billion dollars by the middle of the decade. Optimization of energy resources including grid services like voltage management, peak reduction, and load shaping will become even more critical as DER deployments continue to increase.

Utilities Embracing More than Clean Energy in Face of Climate Change

As expected, a vast majority of utilities recognize that climate change is a disruptive force already threatening current business models, 71 percent. The percentage of respondents acknowledging that climate change is posing a tangible threat increased by two percentage points over last year's survey, 69 percent. We expect that this will continue to increase going forward as destructive weather events will occur more frequently and utilities are taking a lead role in the decarbonization of our economies.

As part of their overall Environmental, Social, and Governance goals, a growing number of utilities have set aggressive carbon emission reduction targets. Some have targeted net zero between 2040 and 2050.

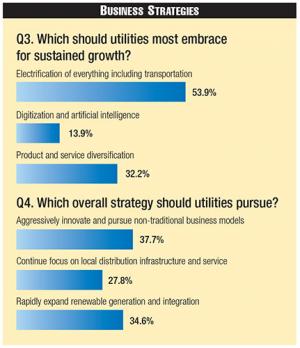

Figure 2 - Business Strategies

Figure 2 - Business Strategies

A majority of survey respondents, 66 percent, favored an all-of-the-above strategy for utilities to proactively respond to climate change threats, including converting generation fleets to renewables and storage, embracing sustainability initiatives across utility operations, and integrating resiliency throughout the network. Factors driving increased prioritization across the industry include changing consumer demand and institutional investors looking to mitigate climate change risk across their portfolios.

Expanding state and local policies and regulations are also pushing the industry to embrace clean energy and efficiency. Despite the lack of clear financial value placed on resiliency initiatives today, the energy industry recognizes the need to embed both resiliency and sustainability into their long-term strategic and financial goals. Adaptation is the new industry norm.

Solar plus storage - either behind the meter or at utility scale - is an increasingly important solution in the utility arsenal to avoid carbon-intensive generation and improve resiliency. By 2021, annual installed distributed solar photovoltaic capacity in North America is expected to exceed ten gigawatts, and annual installed distributed battery storage power capacity is expected to near one gigawatt.

Distributed renewables are interconnecting to the grid at a rate high enough to create new customer-sited power plants in some utility jurisdictions. However, renewable generation plus storage alone will not suffice in designing the resilient utility of the future.

Connected Devices Create More Resilient Intelligent Grid

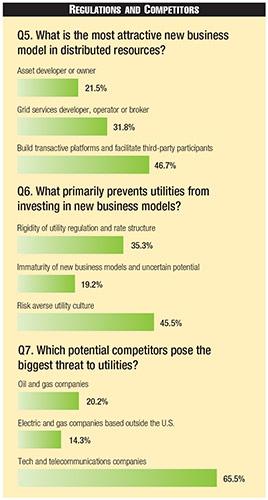

Figure 3 - Regulations and Competitors

Figure 3 - Regulations and Competitors

While grid modernization initiatives remain a high priority for most utilities and a critical evolutionary step to improve grid resiliency, survey respondents were less likely to suggest digitization and artificial intelligence, 14 percent, to support sustained growth. Less surprisingly, utilities will strategically focus on electrification, 54 percent, and product and service diversification, 32 percent, pursuing new revenue opportunities to offset continued decline in overall demand.

With electrification a key focus for utility stakeholders, the intersection of transportation and the grid will continue to be a driver of innovation and partnership for the industry. Analysis from Guidehouse Insights shows that by the end of 2020, approximately two million plug-in electric vehicles are expected to make up the North American fleet. The majority of these vehicles will be individually owned and connected through nearly two million charge ports throughout North America.

The interconnection of plug electric vehicle-charging infrastructure will grow alongside residential and commercial building electrification. In North America, fully electrified homes are estimated to increase more than ten-fold from an installed base of over fifty-four thousand in 2020 to seven hundred and forty-four thousand by 2029.

Commercial electric heat pump shipments, a key component of electrified buildings in North America, are expected to near twenty thousand shipments in 2020 and grow to sixty-five thousand over the same period.

Product and service diversification and business model evolution go hand in hand. With connected DER enabling a new class of prosumers, survey respondents recognize the importance of embracing network orchestration roles like enabling transactive energy and facilitating third-party participants, 47 percent. This is compared to last year, when only 28 percent of respondents in our survey felt that utilities should serve as a transactive energy orchestrator. A DER asset developer or owner role for utilities was favored by only one-fifth of survey respondents, which indicates that utilities will rely on others for that while they focus on the network or platform orchestration role.

Multipronged Approach Will Create Utilities of the Future

Utilities face a myriad of potential new competitors that are competing for the fast-growing new energy assets, products, and services market. Two-thirds of survey respondents identify technology and telecommunications companies as posing the largest threat, 66 percent, which is consistent with our 2019 survey. Somewhat surprisingly, only one-fifth of survey respondents saw oil and gas, 20 percent, and electric and gas companies from outside the U.S., 14 percent, as threats.

Meanwhile, these actors are actively acquiring customers away from U.S. utilities and are leading the way globally by investing in and developing capabilities around next-generation Energy Cloud platforms. The rapidly evolving energy as a service market, projected to reach two hundred and seventy-eight billion dollars in revenue globally by 2028, represents one highly contested market opportunity today. As customers continue to demand leading-edge technologies, services, and rapid issue response and resolution, utilities will need to foster strategic partnerships or better develop their capabilities to compete.

With the energy transformation in full swing, respondents were mostly split over which strategy utilities should pursue. The relative efficacy of aggressive innovation, the pursuit of non-traditional business models, the rapid expansion of renewable generation and integration, and a continued focus on local distribution infrastructure and services will depend on utility-specific factors like policy and regulatory priorities, customer demographics and preferences, and of course the local generation mix and price of electricity. All are important strategic considerations going forward, and will continue to play a key role in a multipronged strategy for most utility stakeholders.

While previous years' surveys consistently pointed to the regulatory environment as a primary inhibitor preventing utilities from investing in new business models, this year's survey showed the utilities' own risk-averse culture, 46 percent, as the biggest hurdle.

Although the immaturity of new business models is a slight concern, 19 percent, sentiment across the industry is still focused on more structural barriers to innovation like restrictive regulations and utility operating culture. This finding suggests an opportunity for regulators and utilities to partner to co-create a more ambitious future vision for the industry.

In closing, we see the energy transformation accelerating. These survey results confirm that utilities are challenged in several parts of their business.

But we see utilities embracing the change and taking a leadership role in many areas. We are just at the beginning. But the opportunity to create new customer and shareholder value is there.

And it's up to utilities to find pathways to unlock this value, while providing safe, reliable, and affordable energy to the communities and customers they serve. Not an easy task, but utilities seem to be better prepared for it then even a year ago.