Lessons from New England on electric-gas market coordination.

Bruce W. Radford is publisher of Public Utilities Fortnightly. Contact him at radford@pur.com.

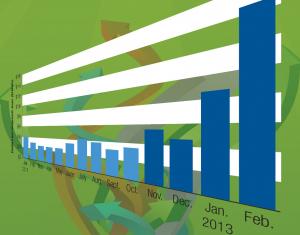

Grid operators in New England had warned for months about relying too much on electric generation fueled by natural gas, yet it came as a rude shock when gas spot prices twice topped $35 this past winter at a key regional pricing hub, the Algonquin Citygate, first during a somewhat abnormal cold snap from January 21 through 25, and then again when winter storm Nemo dropped record snowfalls across New England over the two-day period (Friday and Saturday), February 8 and 9—each time due to constraints and stresses that occurred simultaneously on the delivery systems for both gas and electricity.

But things might have been worse than reported.

When interviewed for this column in mid-march, ISO New England CEO Gordon van Welie went further: “We were seeing intraday prices into the $60 range,” he said.

Compare that with the $3 to $4 price range (per million Btu) that has generally prevailed in the rest of the country over the past year.