“Hedge funds … are unregistered private investment partnerships, funds, or pools that may invest and trade in many different markets, strategies, and instruments (including securities, non-securities, and derivatives) and are NOT subject to the same regulatory requirements as mutual funds, including mutual fund requirements to provide certain periodic and standardized pricing and valuation information to investors. There are substantial risks in investing in Hedge Funds.”1

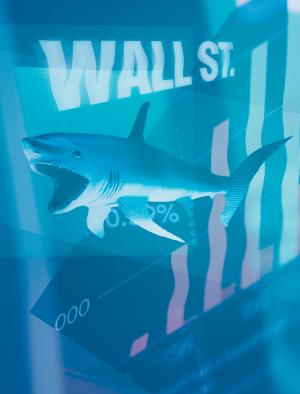

Hedge funds are not mutual funds—a common misconception. Hedge funds are alternative, private investment companies characterized by heightened risk/reward portfolios. Unlike mutual funds, hedge funds use a multitude of strategies to achieve above-average rates of return, primarily by (but not exclusively) taking advantage of market inefficien- cies and dislocations. By operating free of disclosure, managers can pursue aggressive and flexible investment policies. Some funds use borrowing to leverage their portfolios. Stiff dollar entry hurdles and dazzling rates of return have given hedge funds a “wholly-other” or mysterious quality (Otto’s “mysterium”).