PwC

Hugh Le is PwC Principal, Strategy & U.S. and Danny Whigham is PwC U.S. Advisory Sector Leader.

What was once thought to be stagnating to decreasing load growth has begun to shift. Onshoring of manufacturing capacity, building and vehicle electrification, and the expansion of computational needs are creating a new era of load growth. Data centers may encompass future U.S. electricity demand as high as nine percent, per Goldman Sachs.

Society continues to demand more cloud computing power, be it smoother video streaming, wider-reaching cloud enterprise services, and forward-looking applications such as autonomous vehicles. These trends were already driving data center growth before the AI boom of recent years. Power is an essential, if not critical path, to this growth.

Not all grid participants will be impacted the same. Connection requests of fifteen gigawatts in AEP Ohio by 2030 (greater than forty percent increase from peak 2023 load) and eighty gigawatts in Oncor (fifty-nine gigawatts for data centers and greater than ninety percent increase from peak 2023 load), indicate duplicative requests in the queue.

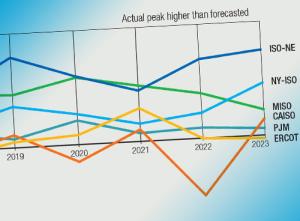

According to EPRI, knowing whether "real" annual demand growth is four percent or fifteen percent is a grid planning team's constant struggle. Looking across known builds highlights the primary markets where data center demand is growing most as well as robust activity in secondary markets.

See Figure One.