Guidehouse

Against the backdrop of pervasive disruption, it is no surprise that the ways utilities operate and interact with stakeholders are changing. As the 2021 Guidehouse and Public Utilities Fortnightly State and Future of the Power Industry executive survey shows, COVID-19-related constraints combined with a rapidly evolving market landscape accelerate these changes.

The influx of market players into the power sector increasingly engaged stakeholders, and proactive customers with connected devices and assets are forcing utilities to reevaluate their strategic priorities. The changes that occurred within the last year alone are proof that utilities can react to these disruptions and prepare for the utility of the future.

Utility Resilience Takes Center Stage after a Challenging 2020

An unprecedented combination of events occurred in 2020 and early 2021. We faced a combination of major weather and climate events including wildfires and deep freezes with associated blackouts, hurricanes, tropical storms, heatwaves, and droughts. We are enduring a pandemic that upended energy consumption patterns and traditional work during the corresponding economic slowdown.

We also experienced one of the largest cyberattacks on critical utility infrastructure. These events accelerated resilience planning across the power industry.

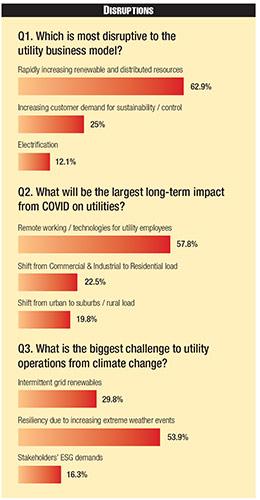

When asked about the pandemic's long-term impacts on utilities, nearly 60% of survey respondents indicated that the shift to remote work and enabling technologies for utility workings would be the most long-lasting.

This sentiment echoes the Guidehouse 2020 Executive Pulse survey which was fielded during the height of the coronavirus outbreak. In this survey, 86% of executive respondents indicated that their organizations would not return to a mostly centralized work environment post-pandemic.

These results, taken in the height of the pandemic and almost one year later, suggest that the strategies developed in response to the pandemic portend a new way of working moving forward.

The other responses about the pandemic's impact were split evenly between a shift from commercial and industrial to residential load (22%) and a shift from urban to suburban and rural load (20%). These results suggest that although a shift in electricity consumption patterns was noticeable, they are expected to return to the pre-pandemic status quo and that enabling the remote workforce is more significant.

Once considered unachievable in many parts of the utility business, remote work quickly became the reality in 2020 as utilities developed innovative processes and mechanisms to engage and support their customers while maintaining reliable service.

Investment in operational flexibility and solutions focused on protecting workers' health and safety were also a priority, which included integrating more digital and advanced technology solutions.

Some of these solutions include virtual customer engagement strategies that protect employees and customers, as well as the use of drones for inspections to limit the number of workers in the field and maintain social distancing practices.

Stay at home orders, remote work and learning, and closure of nonessential businesses caused a drastic shift in residential, commercial, and industrial load shapes in 2020. As a result, utilities are rethinking engagement strategies to support residential customers, including the following:

Discontinuing power shutoffs; Alerting customers of high bills and usage; Implementing virtual home audits; and Focusing on direct marketing of customer energy efficiency and cost-saving programs.

At the same time, an increase in extreme weather events has led to increased pressure from regulators and stakeholders for utilities to invest in resiliency planning efforts, incorporate climate impact analyses, and develop mitigation strategies.

According to the 2021 survey results, over half of respondents (54%) found that resiliency due to increasingly extreme weather events is the biggest challenge to utility operations from climate change, while 30% of respondents reported that intermittent renewables were the biggest challenge.

Mitigation efforts, along with investment in resilient infrastructure, were highly ranked by respondents in the 2020 State and Future of the Power Industry survey as well, underscoring the urgency with which utilities need to act.

Securing the electric grid from physical attacks and cyberattacks is also a high priority for the power industry, according to the survey results. In a definitive answer, 86% of respondents indicated that between cyber and physical security, cybersecurity is the bigger risk to utilities.

Attacks on the grid are evolving, becoming more frequent and malicious. Recent ransomware attacks such as the attack on the Colonial Pipeline and the 2020 SolarWinds attack emphasize the need for robust cybersecurity solutions, especially as utility operations become more flexible and distributed.

Guidehouse Insights anticipates the North American market for utility security could reach $436.8 million by 2029. Increased knowledge of what data, devices, and systems exist, and where, when, and how they communicate is essential for utilities to secure systems and networks.

Utility risk management practices will continue evolving to account for and address the highlighted risks of cybersecurity, climate change and extreme weather events, pandemics, the remote workforce, and increased market competition. Cyber and physical threats loom large for utilities over the next decade and require increased vigilance.

DER Proliferation and the Continued Disruption of the Utility Business Model

The proliferation of distributed energy resources (DER) and clean power are, and will continue to be, a disruption to the traditional utility business model. Mirroring the results from Guidehouse's 2019 and 2020 State & Future of the Power Industry studies, close to two-thirds (63%) of survey respondents in the 2021 survey indicated that the proliferation of DER will have a demonstratable impact on the utility business model and that there are no signs of this changing.

Guidehouse Insights' analysis indicates that DER deployments will outpace centralized generation on a global scale over the coming decade by a healthy margin. By 2030, Guidehouse Insights anticipates that DER capacity additions will be nearly twice that of new centralized generation capacity on an annual basis.

Increased DER uptake and participation is also expected as a result of the Federal Energy Regulatory Commission Order 2222, which intends to remove barriers preventing DER participation in wholesale energy markets. Overall, survey respondents were less concerned with increasing customer demand for sustainability and control (25%) and electrification (12%) as disruptive trends.

Although seen as a disruption, if orchestrated at scale across market participants, increasing DER penetration can be an asset to the industry by enabling more dynamic power markets.

Orchestration of diverse, distributed assets will require a shift away from siloed, top-down approaches. Increasingly, Guidehouse expects greater coordination across supply and demand stakeholders as well as stronger coordination and integration between distribution and transmission systems.

Integration platforms that can aggregate, optimize, schedule, and provide settlements for a multitude of fast transactions are required to enable this future and maintain a flexible, reliable, and balanced grid.

Utility investment is expected to increase steadily in advanced grid management systems, including distributed energy resource management systems (DERMS). Guidehouse Insights anticipates that the North American market for DERMS reaches $720 million in 2029.

Additional investment in utility automation, digitalization, and other advanced software like blockchain and AI will grant utilities greater visualization into the grid edge while providing diverse products and services for customers. Continued deployment and growth of these markets is expected. The global energy blockchain market is expected to grow at a compound annual growth rate of 66.9% by 2030.

Focusing on North America, the market for virtual power plants is anticipated to reach $1.67 billion in 2029, a significant increase from 2020.

Although DER pose an operational threat to disrupt the utility business model, emerging non-energy competitors pose an external threat to how utilities do business with customers. Technology and telecom companies pose the biggest threat to utilities according to 55% of survey respondents, a decrease from 2020 results. 29% of respondents pointed to international electricity and gas companies while 16% cited oil & gas companies as the biggest threat.

Compared to 2020 State and Future of the Power Industry survey results, there was a large increase in the number of respondents who felt that international electricity and gas companies posed a threat as potential competitors.

Since 2019, oil & gas companies consistently have been seen as the least threatening (14%) despite major investments into the power sector. According to Guidehouse's Energy Cloud Investment Tracker, since January 2020, energy markets have seen the largest investments and acquisitions by global utilities in terms of transaction value.

The 4Q 2020 $8 billion investment by Berkshire Hathaway in Dominion Energy's gas and transmission business bolsters this fact. Of total investments and acquisitions since January 2020, Europe is leading the way, followed by North America.

As customer and stakeholder demands increase around environmental, social, and governance (ESG) initiatives, reliability, and monetizing distributed assets, utilities face pressure from competitors to provide services that meet these demands.

The rapidly evolving energy as a service market, which Guidehouse Insights anticipates representing $278 billion in revenue globally by 2028, is among the highly sought-after market opportunities where utilities will face fierce competition and pressure to succeed. In this environment, it is increasingly critical that utilities coordinate with technology providers and relevant stakeholders.

Business Strategies Going Forward

Competition and disruption in the market will force utilities to shift their strategies and uncover new growth opportunities to remain profitable, meet regulator and stakeholder expectations, and retain customers. However, utilities face several challenges in driving innovation and adopting new business models.

The majority of survey respondents (53%) indicated that the rigidity of utility regulation, funding cycles, and rate structures are major barriers for utilities hoping to invest in new business models.

Even as utilities quickly upended traditional processes in response to the pandemic, 30% of survey respondents still believe the risk-averse utility culture is a large inhibitor to business model innovation. This culture is changing as the risk of inaction grows, but it will take time as the old utility guard retires and new people with fresh perspectives come in.

Meanwhile, just 17% of respondents pointed to immaturity of new business models and relative time to scale as inhibitors of new business model investment.

Only one-quarter of major utilities in the U.S. have made progress in developing future-oriented business models, according to Guidehouse's 2020 Energy Cloud Readiness Index study. The same study found that only one in ten utilities have done so proactively with little outside pressure from regulators, customers, or competition.

With the proliferation of DER, interest in ESG and a decarbonized future, and increased market competition, utilities will need to develop strategies to overcome these barriers and find growth opportunities through new business models.

Utilities are already actively deploying new business models. These include energy as a service, subscription-based retail services, electrification, and various models for distributed resources such as transactive energy.

Of the potential business models for distributed resources, survey respondents were evenly split as to which was most attractive (one-third of respondents selected asset developer or owner; one-third grid services developer, operator, or broker; and one-third transactive platform provider and facilitator of third-party participants).

Support was slightly lower for transactive platform providers than what was reported in the 2020 State and Future of the Power Industry survey. Since January 2020, global utility investments and acquisitions have centered on utility scale generation, zero-emission mobility, data analytics platforms, and distributed generation.

Of the 2021 survey's respondents, 56% reported that electrification was the most promising opportunity for sustaining utility growth. Investment in electrification is well-positioned as a pathway for sustained growth for utilities as focus on decarbonization increases and utilities seek out solutions to curb declining revenues.

Through utility partnerships, electrification in buildings and transportation can help reverse declining load while also offering a suite of new products and services for customers.

Meanwhile, 30% of respondents indicated that new and diverse products and services should be embraced as a priority. With the influx of DER, shift toward ESG, changing stakeholder demands, and investment in electrification, new customer products and services will accompany these changes and help expand relationships.

While utilities faced countless challenges in the past year, this year's State and Future of the Power Industry survey demonstrates that the industry continues to embrace change while evolving to meet new challenges head-on.

Given the complexity of disruption across the industry, utility executives will need to remain flexible and vigilant as they navigate an increasingly clean, distributed, mobile, and digitalized future.