Undercounting Explained

Terry Headley, MBA, MA, is a researcher and communications veteran with more than two decades of experience working in the coal industry and in mass communications. He currently serves as communications director of the American Coal Council.

Dr. Roger Bezdek is president of MISI in Washington, D.C. He has over 30 years’ experience in the energy, utility, environmental, and regulatory areas, serving in private industry, academia, and government. He has served as senior adviser in the U.S. Treasury Department, U.S. energy delegate to EU and NATO, and as a consultant to the White House, UN, government agencies, and numerous corporations and organizations.

The U.S. Bureau of Labor Statistics and the U.S. Energy Information Administration estimate that the number of jobs in the U.S. coal industry currently totals about 53,000. This paper utilizes a combination of existing data from various government and industry sources and original research to derive a more accurate estimate of the current coal-dependent employment in the U.S. — taking into account the coal industry's entire profile from mine development and construction, through operations, maintenance, product transportation, and end use.

We estimate that the number of coal-dependent jobs is much larger than generally realized — as much as eight times larger, and totals approximately 420,000. We note that many of these jobs are concentrated in specific local areas where they comprise some of the highest paying jobs available and are critically important to these areas. Thus, the U.S. coal industry remains a major driver of the nation's economy and employment.

We discuss the industry job classification issues and the socio-economic factors that have fundamentally shifted much employment in the industry away from production to support services and away from direct employment to contractor, outsourced, and support roles.

We believe this research is essential to improve decisions that are being made about U.S. economic, energy, regulatory, and regional development policies and the future of one of the nation's basic industries. Policymakers must be provided with the best data available — data that is simply not currently available from existing sources. This research helps fill that void.

How Many Jobs Rely on Coal?

How many jobs are there in the U.S. coal sector? It depends on who you ask. Fewer people work in the coal industry than work at Arby's, is the claim. But is that correct?

Terry Headley: Exclusion of contractor employment estimates represents a serious undercount of jobs. Contractors account for 30-40% of all coal mining jobs.

Terry Headley: Exclusion of contractor employment estimates represents a serious undercount of jobs. Contractors account for 30-40% of all coal mining jobs.

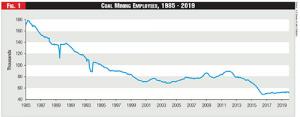

According to the most recent U.S. Bureau of Labor Statistics (BLS) data from 2019, there are about 53,000 active U.S. coal miners, as shown in Figure 1. The U.S. Energy Information Administration (EIA) estimates that the average number of employees at U.S. coal mines in 2018 totaled 53,583.

These BLS and EIA estimates are the numbers the news media usually report. However, the National Mining Association (NMA), using Mine Safety and Health Administration (MSHA) data, reports 55,400 active coal miners and that 27,300 contractors are employed in the U.S. coal industry, for a total of 82,700 active coal industry employees.

This is consistent with a 2018 study conducted by the National Association of State Energy Officials and the Energy Futures Initiative, which estimated 74,180 active coal miners and direct support workers nationwide. The difference between these two estimates could be due to slight differences in the definition of a coal job.

In a broader assessment of the economic and jobs contributions of mining, NMA reports 419,531 total coal jobs, including direct and indirect jobs. This is approximately twenty-seven percent of mining's total employment contribution, and includes the operations of the mine, support activities, and transportation of coal produced.

Figure 1 - Coal Mining Employees, 1985 - 2019

Figure 1 - Coal Mining Employees, 1985 - 2019

See Figure 1.

Contractor Jobs and Coal-Dependent Employment

At the state level, the West Virginia Office of Miners Health, Safety and Training (WVOMHST) reports 15,440 direct coal mining jobs and 37,463 contractors, for a total of 52,903 coal industry jobs in the state — two hundred and forty percent support workers and contractors for each direct coal mining job.

Note that more contractors are reported in West Virginia than are listed by MSHA nationwide, and that the WVOMHST estimate of coal jobs in the state equals the BLS estimate of total coal jobs in the U.S.

By comparison, Pennsylvania reports 5,966 direct mining jobs and just 5,729 support jobs — one percent less than the direct jobs. Kentucky reports 8,700 direct mining jobs and just 6,104 support and contractor jobs — thirty percent less.

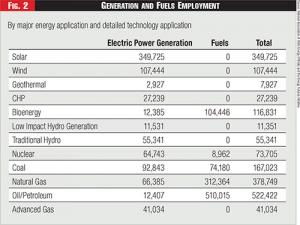

Figure 2 - Generation and Fuels Employment

Figure 2 - Generation and Fuels Employment

MSHA reports only 5,400 contractor coal jobs in West Virginia, which seems low given the tonnage produced, and state statistics that show there are 1,560 contractor companies providing services to the industry.

How should we assess these estimates of coal jobs? Many firms currently provide services to coal companies that the coal companies themselves formerly provided through direct employment, a change that is also true in many other industries.

Those jobs are absolutely dependent on the existence of the local coal mining operations, as is 7.7 percent of all the goods transported in the U.S. by any form of transport, 15 percent of the nation's river barge traffic, as much as 31.4 percent of the jobs on the nation's railroads, as well as jobs processing coal supplies and operating coal-fired power plants — which alone account for 92,843 total jobs, as shown in Figure 2.

See Figure 2.

Roger Bezdek: West Virginia and Kentucky have the counties suffering most from coal mining job losses and will be most negatively impacted by future job losses.

Roger Bezdek: West Virginia and Kentucky have the counties suffering most from coal mining job losses and will be most negatively impacted by future job losses.

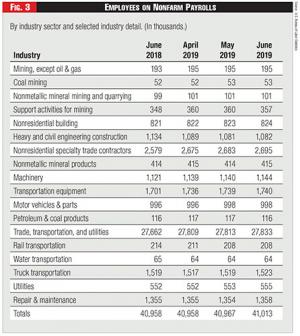

BLS provides additional perspective on mining-dependent employment. As shown in Figure 3, nearly 357,000 jobs are in support activities for mining. While BLS provides no disaggregation of the number of those jobs associated with coal, a reasonable estimate can be derived by applying the ratio of direct coal employment versus other mining employment to the total number of support jobs. This results in an estimate of approximately 96,000 coal support jobs.

Adding the 53,000 direct mining jobs BLS reports result in an estimate of more than 149,000 total coal mining and mining-dependent jobs across the U.S. — using only the direct coal mining and, "Support Activities for Mining" categories.

Further, using the estimates above and adding the 92,000 utilities jobs, fifteen percent of the water transportation jobs (10,500) and thirty percent of the railroad transportation jobs (62,400) included in their own BLS categories and referenced above provides an estimated total of 313,900 coal-dependent jobs.

Adding in the miscellaneous coal-dependent jobs distributed through other BLS classifications, such as engineering and construction among others, supports NMA's estimate of 419,000 jobs.

Figure 3 - Employees on Nonfarm Payrolls

Figure 3 - Employees on Nonfarm Payrolls

See Figure 3.

This estimate of approximately 400,000 U.S. coal-dependent jobs is supported by other research findings. For example, a study for the U.S. Department of Energy analyzed the current state of the U.S. coal industry and jobs. It used the employment concept of a full time equivalent (FTE) job in the U.S. and estimated the total (direct, indirect, and induced) jobs:

Direct jobs are those created directly in the specific activity or process; Indirect jobs are those created throughout the required interindustry supply chain; Induced jobs are those created in supporting or peripheral activities; and Total jobs are the sum or all of the jobs created.

It found that current data greatly underestimates the size and importance of the coal industry: Failure to include contractor employment undercounts mining jobs by thirty to forty percent; Including indirect jobs effects increases the jobs generated by a factor of 3 to 4; Coal is vital to U.S. manufacturing and railroads; and Coal-related jobs are essential to many regional and local economies. The study estimated that there are currently about 400,000 coal-dependent jobs in the U.S.

Job Classification Issues

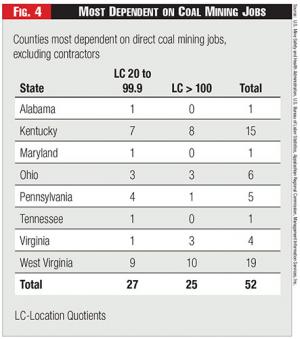

Figure 4 - Most Dependent on Coal Mining Jobs

Figure 4 - Most Dependent on Coal Mining Jobs

The BLS and MSHA data are derived from mining company reports using standardized job classifications based on the North American Industrial Classification System (NAICS) code, specifically NAICS code 2121 for coal mining.

This includes jobs that "primarily engage in mining, mine site development, and beneficiating (such as preparing) metallic minerals and nonmetallic minerals, including coal. The term 'mining' is used in the broad sense to include extraction, quarrying, and beneficiating (such as crushing, screening, washing, sizing, concentrating, and flotation), customarily done at the mine site."

Additional jobs, such as trucking, vendors, and other categories listed above are not included in that NAICS code but instead are included largely in NAICS code 2131, "Support Activities for Mining," and are shown in Figure 3. Still other coal-dependent jobs do not fit into these categories at all and are not even counted as support jobs, such as those at Marshall Miller & Associates (MM&A), a Bluefield, Virginia-based engineering firm, for example.

According to Scott Keim, president of MM&A, "More than fifty of our employees are directly dependent upon the coal industry for employment. This includes mining engineers, civil engineers, geologists, environmental scientists, engineering technicians, accountants, and technical support staff. Many of these staff members have been employed by MM&A for over twenty-five years."

Nevertheless, these jobs are not included in the count of coal jobs. Keim stated that he thinks these jobs definitely should be because, "they would likely all lose their jobs if the coal industry were to shut down." However, the employees of MM&A are listed by the BLS under the category of "Heavy and Civil Engineering," which contains more than one million total jobs nationwide.

How many more engineering companies provide full-time support to the coal industry? Even the BLS does not know. BLS stated that when someone calls asking for the number of coal jobs in the U.S., they will be told 53,000. BLS verified that companies like MM&A are not included in the support jobs category.

More generally, coal and mineral mining contractor employment data are collected by company in the MSHA mine safety survey, not by mine. Thus, for example, there is no differentiation for an engineering company that may have its corporate headquarters office in Morgantown, West Virginia and how many employee-hours were spent in mines in West Virginia, Virginia, Pennsylvania, or Ohio mines — all of which may be within fifty miles of the corporate headquarters office.

Exclusion of these contractor employment estimates from the state estimates represents a serious undercount of coal mining jobs. Contractors account for 30-40% of all coal mining jobs and have been comprising an increasing share of the coal workforce.

Coal-Dependent Communities

It is important to demonstrate, as this analysis has, that coal sector jobs must be assessed in the full context of the approximately 420,000 jobs generated. These jobs represent only about 0.3 percent of the U.S. labor force. However, many of these jobs are concentrated in specific local areas and are critically important to these areas.

Coal-dependent jobs are not only a significant portion of the labor force in many communities, they are also among the highest paid jobs available, especially in the coal-producing regions of the country — coal is mined in twenty-three states, but seventy percent is mined in five states.

For example, in Belmont County, Ohio, the average weekly wage of a service job is five hundred and seventy-five dollars, whereas coal miners earn sixteen hundred dollars per week. In eastern Kentucky, coal mining jobs pay nearly three times the average wage. According to NMA's estimate, coal contributes approximately fifty-eight billion dollars annually to U.S. GDP.

Further, coal power plants provide good, well-paying jobs that are hard to replace. For example:

Giles County, Virginia Administrator Chris McKlarney stated, "The Glen Lyn plant provided stable, well-paying positions with good benefits in places where they are hard to find."

Avon Lake City Council member Robert James testified, "The type of quality jobs at Avon Lake plant are hard to find in the Cleveland area."

According to Salem, Massachusetts Mayor Kim Driscoll, closing the Salem Harbor Station is, "not like losing a Dunkin' Donuts."

"Not only are good-paying jobs being lost at the Armstrong Power Plant; jobs will be lost in ancillary industries, support services, and by small coal-mining operations," Dave Battaglia, chairman, Armstrong County, Pennsylvania Board of Commissioners.

"With a hundred good-paying jobs, the Eastlake plant is among the top employers in town. Closing the plant is a huge hit." Eastlake, Ohio mayor Ted Andrzejewski.

This issue has most recently become salient in Farmington, New Mexico. Public Service Company of New Mexico has proposed to close the San Juan Generating Station (SJGS), and, effectively, the San Juan Mine (SJM) — which supplies the plant's coal — in 2022.

Local government officials and Navajo Nation representatives are fighting to keep SJGS and SJM in operation. They fear the devastating impact that the shutdown of the plant and the mine will have on the local economy, jobs, and economic development. SJGS and SJM are major sources of employment and income for the Navajo.

They fear the devastating impact that the shutdown of the plant and the mine will have, and estimate that:

Job losses could total nearly sixteen hundred; Local area earnings would be reduced by a hundred and twenty million dollars annually; Over fifty million dollars in tax revenues would be lost annually; and Hundreds of local families and businesses would be adversely affected.

They also estimate that: The property tax base of Central Consolidated Schools, San Juan College, and San Juan County will be enormously diminished; and The Central Consolidated School District — where over ninety percent of the students are Native American and nearly seventy-five percent of the students are disadvantaged — would lose fifty percent of its property tax revenues.

These fears are well founded. San Juan County suffers from a poverty rate above twenty percent, it is experiencing declining population and economic prospects, and its population is sixty percent minority. The Navajo Nation is especially at risk, since it has many of the characteristics of a third world nation.

For example: Over the last twenty years, unemployment in the Navajo Nation has been nearly fifty percent — compared to, currently, 4.8 percent in New Mexico and 3.6 percent in the U.S.; Navajo Nation median household income is twenty thousand dollars — compared to forty-seven thousand dollars for New Mexico and sixty thousand dollars for the U.S.

In addition, forty-three percent of those living in the Navajo Nation earn below the federal poverty level; fifty-four percent of children in the Navajo Nation live in poverty; and in the Navajo nation, thirty-eight percent percent of residences lack electrical service and running water, and eighty-six percent are without natural gas service.

It is of special concern because jobs at the SJGS and the SJM are among the highest paying and most sought after in the region. Their workers have employer sponsored healthcare and earn an average of eighty-six thousand dollars.

These earnings are more than twice the local average and are even three times higher than the average San Juan County family income. An average plant employee can expect to earn a salary and benefits worth a hundred and seventeen thousand dollars (or more) annually.

The SJGS alone produces seventy million dollars a year in salaries and benefits to its workforce, which will be virtually impossible to replace. As Farmington Mayor Nate Duckett noted, "This is a state that sits in the bottom of the economic barrel, so to speak, and trying to attract new industries and new jobs to this area is very difficult."

Coal has lifted Navajos out of poverty: "They were able to change their families' economic prosperity in one generation, meaning that one or two families' members worked at the mine, made a good wage, they were able to put their kids in college."

Data on coal mining industry concentrations by county illustrate the heavy economic dependence on coal mining in specific counties, especially in Appalachia. Location quotients (LCs) measure how concentrated jobs in coal mining are in a county, compared to the national average concentration.

Any county with a concentration greater than 1.0 indicates that it has disproportionately more jobs in coal than the U.S. as a whole. Most U.S. counties have no coal mining employment. However, in Appalachia there are fifty-two counties with a LC of twenty or more, meaning that coal mining is at least twenty times more important to local jobs than in the U.S. as a whole, and some Appalachian counties have location quotients that exceed a hundred.

Of the seventeen Appalachian counties with LCs of a hundred and fifty or more, coal mining represents ten percent or more of the total jobs in the county. These are extraordinarily high levels of industry concentration and they are also generally associated with recent coal mining job losses. Most important, counties with LCs greater than twenty have economies and job markets that are especially susceptible to changes in the fortunes of the coal mining industry.

Figure 4 shows that in Appalachia: There are twenty-seven counties with LCs between twenty and ninety-nine; There are twenty-five counties with LCs greater than a hundred; Of the fifty-two counties with LCs greater than twenty, thirty-seven percent (19) are in West Virginia and twenty-nine percent (15) are in Kentucky.

It also shows that: Of the twenty-five counties with LCs greater than a hundred, forty percent (10), are in West Virginia and thirty-two percent (8) are in Kentucky; and no other state has more than six counties with LCs that exceed twenty, and three states — Alabama, Maryland, and Tennessee — have only one county with an LC greater than twenty.

See Figure 4.

As noted, of the fifty-two counties with LC's greater than twenty, nineteen (37 percent) are in West Virginia and fifteen (29 percent) are in Kentucky. Thus, these two states contain two-thirds of the Appalachian counties most heavily dependent on coal mining. Further, of the twenty-five counties that have LCs greater than a hundred, ten (40 percent) are in West Virginia and eight (32 percent) are in Kentucky.

Thus, these two states have nearly three quarters of the Appalachian counties the most highly dependent on coal mining jobs. Ominously, these are the counties that have, by far, suffered the most from recent coal mining job losses and will be the most negatively impacted by future job losses.

Finally, it must be recognized that coal power plants provide reliable, dispatchable, and affordable electricity, and this has important economic and jobs impacts. While discussion of this issue is outside the scope of the current paper, there is a negative relationship between energy price changes and economic activity. Review of the literature indicates that a reasonable long run value for this elasticity for electricity is about -0.10.

This indicates that a ten percent increase in electricity prices will result in a decrease in GDP or gross state product of one percent and a similar reduction in jobs. The salient point is that coal power plants produce reliable, inexpensive electricity and replacing them with higher cost facilities will, inevitably, cause electricity costs and rates to increase significantly and have a negative effect on the economy and jobs.

Conclusions

The U.S. coal industry played a central role in the development of the nation, but its future role is currently being debated. A future free of coal is what some are currently advocating, contending that coal is a "fuel of the past" — a "dirty" relic of the industrial revolution that is fading from use and must be abandoned in the fight against global warming.

The argument is also that the coal industry is relatively insignificant, with U.S. coal industry employment declining from a half-million in 1950 to currently only about fifty-three thousand. And, as noted, that it is an unimportant industry that employees fewer workers than Wendy's.

However, we find here that coal-dependent jobs in the U.S. are, in reality, eight times larger than the 53,000 jobs estimate and total approximately 420,000. This number represents a more accurate estimate of the jobs impact of the coal industry in the U.S. Further, these jobs are disproportionately concentrated in specific regions, such as Appalachia and in a number of states and communities, where they comprise some of the highest paying jobs available.

This information must be considered by policymakers in formulating optimal economic, energy, enviromental, empolyment, and regional development policies.

Acknowledgements: The authors are grateful to Betsy Monseu, Robert Wendling, and Kenneth Kern, for reviewing previous drafts of this manuscript. The opinions expressed here, and any errors are the sole responsibility of the authors.

Lead image: © Can Stock Photo / photosoup