Profiles in Innovation

Charles Vinsonhaler was nominated for Fortnightly Top Innovators 2019 by EPRI.

What makes someone a top innovator? Where did they come from in their organization? What caused them to dream up their innovation? And how do they plan to further build on this development? We posed these questions to some of this year's top innovators.

PUF: Why is this SOLVE tool important for the industry and the customer?

Charles Vinsonhaler: We initiated this research because we were hearing from stakeholders and utilities that they needed a better understanding of sustainability value. They were looking at investments and knew that the investments are producing sustainability value but weren't able to articulate that value and weren't able to analyze that value on a consistent basis.

There was an ask from our members in Program 198, our Strategic Sustainability Science program, to develop resources that would allow them to better understand sustainability value, and in turn allow them to make more informed investments, so that as they made every-day investments in their generation, in systems, in grid operations, they could ensure that those investments had a sustainability component and were ultimately informed by strategic sustainability goals.

We started with a literature review where we analyzed existing sustainability ROI methodologies. We looked at twenty methodologies across private sector, consulting, and academia. One of the findings is that we didn't identify any methodologies specific to utilities. We knew we were creating a novel product.

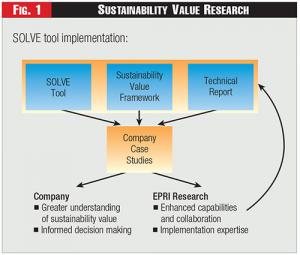

Figure 1 - Sustainability Value Research

Figure 1 - Sustainability Value Research

We identified themes. We used the themes and their approaches to sustainability value to develop a visual framework so we could better articulate what we were capturing. We see this framework as a way to educate internal and external stakeholders about sustainability moving forward. From there we produced the SOLVE tool.

PUF: What's the value of clean air or water or other sustainability values that a project might have? That's always been difficult. How do you do that?

Charles Vinsonhaler: It is difficult, and we have seen in the past that government agencies and public actors have attempted to calculate these benefits. You hit on some of the key ones like clean air and water, because these are the ecosystem services we take for granted.

What we focused on with this tool is not providing coefficients. We weren't thinking about providing the value for clean air or a gallon of clean water because we recognize that value changes over space and time. The value of a gallon of water in Los Angeles is much different from the value of a gallon of water in Michigan.

Figure 2 - SOLVE Tool Implementation

Figure 2 - SOLVE Tool Implementation

Our goal wasn't to develop coefficients. It was to develop a process that would allow a company to consistently perform a project analysis. Value is specific to a utility. A company thinks about sustainability value from an internal perspective. What do we as a company need to do to be a better business, and from an external perspective, what are our stakeholders expecting from us?

The way the tool calculates value is specific to a company. It starts off by asking the company to calibrate the tool by identifying and prioritizing the sustainability issues that are most important, and then analyze the project through that lens of those issues. That way, what the tool ultimately produces is a quantitative number, but it's informed by the qualitative perspective of that company.

PUF: If I have a project, and I run it through SOLVE, what does the output look like?

Charles Vinsonhaler: The output is articulated using EPRI's twenty priority sustainability issues. Those were issues that we did extensive research on in 2017. We engaged with power companies and external stakeholders. We fielded surveys from over three hundred representatives from the power company, and also performed interviews to identify the most important issues for sustainability performance in the power industry.

The tool produces value based on those issues. The tool will identify an opportunity around a certain issue, so the project is going to produce a lot of value in relation to air emissions, for example.

In addition, the tool will identify a risk. It could say this project has a high risk to your water issue. So, you're creating some risks through this project. We call it a heat map. The tool produces a heat map based on your sustainability perspective as well as the estimated impacts of the project. Companies are then able to use that heat map to develop a strategy for the project.

PUF: You could show the heat map to your CEO or board of directors or Commissioners or Governor's office or other stakeholders and say, well here's how this would play out.

Charles Vinsonhaler: Yes. We currently are cautious in the way we share results with external stakeholders because we are in version one of the tool. But you captured the vision for the project, which is, we know regulators want a better articulation of the sustainability value associated with projects. We know investors are asking companies, what are you doing to ensure your projects are sustainable?

We see this suite of research and this tool eventually being something that utilities can point to and say, this is what we're doing. This is how we're capturing sustainability value. This is how we're informing our projects and the decisions we're making.

PUF: How did this get started and where does it go from here?

Charles Vinsonhaler: Solve stands for sustainability optimization leveraging value estimation. We're trying to optimize the sustainability of each project by estimating its impact on sustainability values, and those values are specific to the company.

When I mentioned EPRI's twenty priority sustainability issues, the tool allows you to adjust those issues for your company. If you feel like one of our issues should be adjusted slightly or maybe we forgot an issue, there is an opportunity to add an issue to make sure it's reflective of your company's priorities.

This is version one of the tool. That's why we have case studies with twelve companies ongoing because we recognize the value in applying the tool, seeing how members can use the tool, and learning from their experience. We can sit in the lab and make tweaks and edits, but unless it's informed by actual experiences, it's not going to be valuable for the industry.

We have a plan to release version two in 2020. Then we want to conduct case studies, test that with our members, and continue to drive enhancements. We've already seen value from the tool in two ways.

First, I mentioned that the tool requires a company to prioritize issues specific to its sustainability context. We've been doing workshops with companies. We'll go to a company, get a group together, and do a workshop where we go through each issue and ask them to prioritize the issue.

These workshops have produced two results. We did a workshop at an executive retreat, and the executives had a conversation about their issues. But they hadn't thought about, what is our strategy? How are we going to invest in these issues moving forward?

We also did a workshop at a different company with managers and directors. Through the workshop they realized, hey, we both work on this same issue. I didn't know you were doing that.

Another way that we're seeing value out of the tool is we had a company that ran through the entire analysis and said, we made calculations based on the questions that the tool was forcing us to ask. We have some real numbers and data that we didn't have before. So, this tool is capturing outcomes that our current project analyses don't capture. We see the value in the tool as a framework for how we're analyzing projects moving forward.

PUF: How did you see your role?

Charles Vinsonhaler: I was there on the day-to-day. We had a contractor help us with some of that literature because thumbing through twenty methodologies is a lot of work.

I was managing that literature review and the initial research. I came to EPRI a year ago, and this was the first project I started working on. We started with the development of the concept, and I helped develop the framework and showed that visual framework to our members, getting their feedback, and tweaking that.

Then we moved on to the tool, and that was where I used my Excel experience and did some functions and formatting on the Excel side and built the tool up from ground up. I'm familiar with the tool, and that has been helpful as we adjust and look at version two. It's been a streamlined process because we can adjust the tool in-house.

As we've been testing the tool, I've been the main point of contact on these case studies. When we did the two workshops, I was the main support. Morgan Scott was the workshop facilitator.

Moving forward, as we have kickoff calls and talk about the case studies and where they're going, I'm maintaining that information. At the end of this year, I'll be publishing technical updates on the tool, what we've learned, and where we see the tool moving. I'll be writing and publishing that.

Fortnightly Top Innovators 2019 articles:

- Fortnightly Top Innovators 2019

- Fortnightly Foremost Innovators 2019

- Profiles in Innovation

- PSEG's Emmanuel Ansah, Will Barnes, Lauren Biernacki, Julie Duncan, Lisa Garcia, Sal Orsino, and Jared Osorio

- PPL Electric Utilities' Patrick Barnett, Mychal Kistler, and Ihab Salet

- Southern Company's Clifton Black

- ABB's Luiz Cheim

- EPRI's Kirk Ellison and Jeffery Preece

- EPRI's Charles Vinsonhaler

- Arizona Public Service's Kim Wagie