Are the Benefits Real?

Tom Flaherty is a Senior Advisor to Strategy&, part of the PwC network, with over forty years of experience consulting to utilities. He has been involved in the vast majority of US utility transactions addressing potential synergies, regulatory strategy, transaction testimony and merger integration.

Todd Jirovec is a Principal with Strategy&, part of the PwC network, with over twenty years of consulting experience. He specializes in M&A, corporate strategy, business transformation and, financial performance.

The current era of utility sector consolidation has now extended through three consecutive decades of sustained activity. Since the late 1980s, power and gas companies have been in a near continuous state of combination or rationalization with industry partners or financial sponsors.

Even with this substantial consolidation among industry participants, the utilities sector has achieved far less concentration than other sectors like airlines, telecommunications, health care, or commercial banking.

In today's environment, utilities' merger and acquisition interest remain high, capital costs are still low, regulatory orders acceptable, and actual post-close integration has created sustained benefits. Strategic, financial, operating, customer, and cost areas have each been positively affected through consolidation.

However, many observers are still skeptical about where and how these benefits from consolidation have been derived. Understanding the impacts from prior transactions may tell us a lot about what the industry has actually accomplished and can continue to attain.

Transaction Cycles

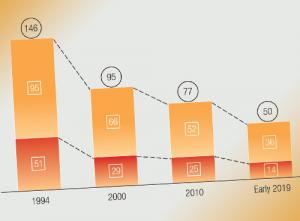

Today's power and gas utilities sector is the product of steady consolidation occurring in a series of natural cycles. These cycles existed between 1989 and 1994; 1995 and 2000; 2001 and 2010: and 2011 through today.