Addressing Costs Imposed on the Grid

Charles Bayless recently retired as President and Provost of the West Virginia University Institute of Technology. Previously he was Chairman, President, and Chief Executive Officer of Illinova Corporation and its wholly owned subsidiary, Illinois Power Company. Prior to joining Illinova Corporation, he was Chairman, President, and Chief Executive Officer of Tucson Electric Power Company.

"However beautiful the strategy, you should occasionally look at the results." — Winston Churchill.

As we deregulate our markets, and simultaneously transition our energy supply to renewable energy, many interesting interactions are occurring between our old and new systems. In the physical world, the increased need for ancillary services due to the variability and un-dispatchability of renewables clashes with a system built for controllable plants. But an equally interesting set of interactions occurs as the free and regulated markets clash.

Renewables require more ancillary services such as balancing, frequency and voltage support, and reserves. To understand this, consider the services needed for stability and reliability on a grid run by four-thousand-megawatt controllable elephants or a grid run by a thousand four-megawatt cats.

The extra cost of these services is overwhelmed by the environmental externality cost of fossil fuels. As a society, we have no choice but to transition to renewables. However, as we transition, our current market structure ignores these services and is not able to make the correct decisions, which will lead to much higher societal costs.

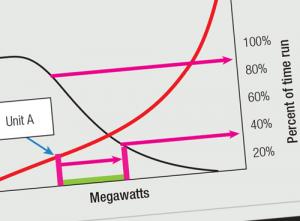

To understand how the market is failing, let's start with how and when units are dispatched. To understand this, we need to begin with a utility's load characteristics.