PSEG, NextEra, Wisconsin Energy, OGE Energy, Pinnacle West, IDACORP, etc.

Steve Mitnick is Editor-in-Chief of Public Utilities Fortnightly and author of the book “Lines Down: How We Pay, Use, Value Grid Electricity Amid the Storm.”

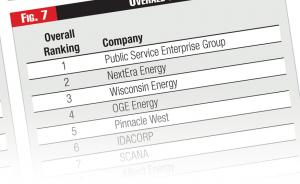

The PUF Top Twenty Financial Performers were selected through a ranking of six financial metrics. Their ordering, from first to twentieth, was based on a simple average of their six ranks.

Public Service Enterprise Group came in first this year. The Newark, New Jersey based company was one of the top twenty, and the first among them, by ranking first against one of the financial metrics, third against two of the metrics, fourth against two of the metrics, and eighth against the remaining metric.

NextEra came in second this year. The Juno Beach, Florida based company ranked first against one of the financial metrics, third against one of the metrics, fourth against one of the metrics, sixth against one of the metrics, tenth against one of the metrics, and sixteenth against the remaining metric.

Wisconsin Energy came in third this year, tied with OGE Energy. The Milwaukee, Wisconsin based company ranked second against one of the financial metrics, third against one of the metrics, fourth against one of the metrics, eighth against one of the metrics, ninth against one of the metrics, and fifteenth against the remaining metric.

OGE Energy also came in third this year. The Oklahoma City, Oklahoma based company ranked second against two of the financial metrics, fifth against two of the metrics, tenth against one of the metrics, and seventeenth against the remaining metric.

The top five, or six because of another tie, includes Phoenix, Arizona based Pinnacle West and Boise, Idaho based IDACORP. Just missing the top five, but among the top ten, were SCANA, Alliant Energy, Southern Company and PPL Corporation.

The rest of the top twenty were American Electric Power, AES Corporation, Vectren, CMS Energy, Consolidated Edison, Sempra Energy, Northwestern Corporation, Xcel Energy, Avista Corporation, and DTE Energy. Congratulations to this year’s PUF Top Twenty!

And trends? Though the Top Twenty companies hail from all regions of the country, we do note that the Midwest and northwest were particularly well-represented.

In the Midwest, the Top Twenty includes two investor-owned utilities that primarily serve the state of Michigan and two that primarily serve the state of Wisconsin. And one that primarily serves the state of Indiana, and another that serves Michigan, Indiana and Ohio (American Electric Power). That’s six of the Top Twenty companies.

In the northwest, the Top Twenty includes companies based in Idaho, Montana and Washington state. That’s three of the Top Twenty companies for a relatively unpopulous corner of the nation.

If your company is mainly an investor-owned gas utility, or a relatively small investor-owned electric utility, or a non-utility owner of electric and gas assets in our industry, there’s no reason to be disappointed. The Top Twenty focuses on those companies that are mainly investor-owned electric utilities with revenues last year exceeding a billion dollars.

So here we offer a quick look only at these other kinds of companies in our industry. Among the larger gas utilities, New Jersey Resources, EQT, Piedmont Natural Gas, and Southwest Gas scored well against the six financial metrics. Among the smaller gas utilities, Delta Natural Gas, Chesapeake Utilities, South Jersey Industries, and RGC Resources scored well too. These companies typically have significant non-utility operations.

Among the smaller electric utilities, MGE Energy, El Paso Electric, Otter Tail Power, UGI, and Empire District Electric scored well against the metrics. Among the non-utility asset owners, Calpine Corporation scored well too.

Excluded from the rankings were companies that have been acquired or in the process of doing so. So you’ll not see in our lists Questar (Dominion Resources), ITC Holdings (Fortis), AGL Resources (Southern Company), Westar (Great Plains Energy), and TECO Energy (Emera). These five companies otherwise performed well against the metrics.

Let’s now turn back to the specific rankings for investor-owned electric utilities with revenues exceeding a billion dollars. How did each of the Top Twenty companies fare against each of the six financial metrics?

The first of the six financial metrics is the four-year average profit margin (income from operations divided by revenue). IDACORP took first place in this ranking. PPL Corporation, NextEra Energy, Public Service Enterprise Group, and OGE Energy were just behind IDACORP. See Figure 1.

The second of the six financial metrics is the four-year average dividend yield (dividends divided by closing price). Alliant Energy took first place in this ranking. PPL Corporation, Southern Company, Public Service Enterprise Group, and Consolidated Edison were just behind Alliant Energy. See Figure 2.

The third of the six financial metrics is the four-year average free cash flow (cash flow divided by revenue). NextEra Energy took first place in this ranking. Wisconsin Energy, Pinnacle West, IDACORP, and Consolidated Edison were just behind NextEra Energy. See Figure 3.

The fourth of the six financial metrics is the four-year average return on equity (net income divided by equity). AES Corporation took first place in this ranking. CMS Energy, Public Service Enterprise Group, Wisconsin Energy, and OGE Energy were just behind AES Corporation. See Figure 4.

The fifth of the six financial metrics is the four-year average return on assets (net income divided by total assets). Public Service Enterprise Group took first place in this ranking. OGE Energy, Wisconsin Energy, SCANA, and IDACORP were just behind Public Service Enterprise Group. See Figure 5.

The sixth of the six financial metrics is the four-year average sustainable growth (return on equity times the complement of the dividend payout ratio). AES Corporation took first place in this ranking. OGE Energy, Public Service Enterprise Group, NextEra Energy, and IDACORP were just behind AES Corporation. See Figure 6.

Figure 7 shows the overall list, ranking the Top Twenty in order.

Related: See “Top Twenty, and Why Financial Strength Matters,” October 2016, by Steve Mitnick.