Participation rates, customers’ bills, meaningful choice

Laurence Kirsch is a Senior Consultant with Christensen Associates Energy Consulting. He specializes in economic analyses for the electric utility industry, including studies of wholesale markets, power pool operations, electric power system cost structures, reliability costs, market power, renewable portfolio standards, and greenhouse gas limitations. Mathew Morey is a Senior Consultant with Christensen Associates Energy Consulting. He specializes in renewable energy policy and pricing, transmission congestion management and pricing systems, market monitoring, market design, and incentive regulation.

In the 1990s, deregulation advocates claimed that retail choice would provide significant gains in the forms of lower retail prices and innovative products and services. After twenty years, the empirical evidence strongly suggests that retail choice has delivered only a part of its advertised benefits, and that the lion's share of the benefits attributable to electricity sector restructuring is due to wholesale competition rather than retail competition.

Impetus for Wholesale Electricity Competition

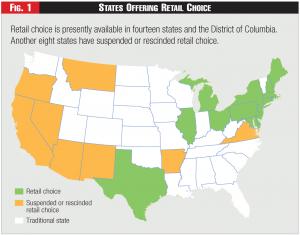

Figure 1 - States Offering Retail Choice

Figure 1 - States Offering Retail Choice

The Public Utility Regulatory Policy Act of 1978, PURPA, was the camel's nose under the tent for wholesale electricity competition. PURPA provided strong incentives for improvements in the efficiency and availability of unregulated generators, which included fossil-fired generators up to eighty megawatts as well as renewable resources. Unlike regulated generators, unregulated generators could keep as pre-tax profit every dollar of cost savings. And unregulated generators could receive revenue only when their plants produced power.