The ITC merger and link-up with MISO.

Bruce W. Radford is publisher of Public Utilities Fortnightly. Contact him at radford@pur.com.

The thing to know about Entergy’s bid to join the Midwest ISO—and its plan to first sell its transmission lines to burgeoning grid giant ITC—is just how many moving parts are involved.

Instead of consolidating the transaction within a single application filed at the Federal Energy Regulatory Commission, where regulators and industry stakeholders might debate the full range of issues, the three principals have sliced and diced their deal into many separate smaller pieces, each with its own docketed proceeding at FERC. This makes it difficult for would-be opponents to get a handle.

Much will depend on whether Entergy’s planned sale of its grid assets to ITC will clear FERC approval by June as planned, six months ahead of Entergy’s anticipated integration into MISO in mid-December, which is timed to coincide with the date that Entergy’s Arkansas distribution utility will quit Entergy’s long-running multi-state system agreement. So it won’t be until the last weeks of 2013 when the Entergy retail arm will bring in its generation and load to join MISO as a transmission-dependent market participant.

But if clearance is delayed or denied on the ITC sale—designed as a tax-free merger conducted through a Reverse Morris Trust—Entergy could end up still possessed of its grid network come December. And in that case, Entergy would end up joining MISO as a full-fledged transmission owner (TO), with different tariffs and an entirely different set of regulatory consequences.

If all goes well, and ITC acquires Entergy’s grid in June as scheduled, MISO will immediately take functional control over the newly acquired lines. Yet with ITC joining MISO as owner of a multi-state grid network, minus the historic generation and load that grid network was meant to serve, that means MISO for six months would operate the new ITC lines in “Day One” mode—without a day-ahead or real-time energy market within Entergy’s four-state service territory (to be known as “MISO South”). That will make it impossible for MISO to price and reconcile congestion through its bid-based, security-constrained dispatch. Think “RTO Lite.” There simply won’t be any nodal locational prices (LMP) within Entergy during this interval.

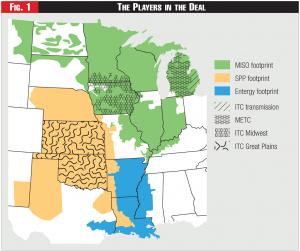

Figure 1 - The Players in the Deal

Figure 1 - The Players in the Deal

Nor would MISO have control during this interval over Entergy-area gen plants for redispatch, or for balancing or other ancillary services. Entergy instead would serve as balancing authority for MISO South during this time, requiring FERC approval of still another custom-designed, temporary tariff.

Also in limbo are the templates and protocols for the forward-looking transmission formula rates that will set the revenue requirements for the transmission assets newly placed under MISO’s functional control. Using those formulas, MISO would calculate and collect a new transmission access charge for each of four newly created wholesale transmission pricing zones, as it does now for its many other member TOs.

ITC has promised to reveal its proposed, forward-looking transmission formula rate templates, with spreadsheet entries fully populated with the requisite cost data, in a tariff application to be filed with FERC in June to establish its revenue requirements for the four new wholesale transmission pricing zones to be created in MISO South. Until then, however, state regulators will have no reliable final figures for how wholesale transmission rates will change under ITC ownership.

Granted, Entergy did file its own set of proposed formula rate templates, populated with cost data, for the same set of four future pricing zones. (See, FERC Dkt. ER13-948, filed Feb. 15, 2013.) But that probably won’t prove of much value to state regulators seeking answers, as Entergy would put that tariff in effect only if the wires sale to ITC fails to clear.

The Rejected Suitor

The biggest question mark concerns the effects on economics and physical operations within the Southwest Power Pool, which has complained vigorously on how it will fare under the deal, much as would a rejected suitor—which of course it is.

Recall that the smart money initially was on SPP as the RTO that Entergy would join. In fact it was FERC that had called that ground-breaking technical conference held in Charleston, S.C., in June 2009, meeting with state utility commissioners from across the Entergy footprint to talk about strategic options. And it was FERC that then hired Charles River Associates to conduct a cost-benefit study on Entergy (and Cleco Power) joining SPP as member TOs.

But SPP, lacking a competitive regional wholesale power market, eventually fell out of favor.

MISO, which won the glass slipper, is nevertheless very weakly connected electrically with Entergy, with a firm contract path transfer capability of only about 1,000 MW. Yet according to SPP, MISO has stated in the past that it plans to dispatch up to 4,000 MW of energy from North to serve its new South (Entergy) Planning Area, implying significant parallel flows across the SPP grid—about 30 percent—with only about 8 percent of the transferred energy flowing directly over MISO’s existing interconnection with Entergy. (Protest of SPP, pp.8-9, FERC Dkt. EC12-145 et al., filed Jan. 22, 2013.)

And as the SPP TOs have noted, these “massive” loop flows will occur precisely because SPP in fact is 14 times better connected with Entergy—“14,000 MWs of physical capability over multiple interconnections”—than is MISO. (Protest of SPP TOs, p. 19, filed Jan. 11, 2013.)

And the Tennessee Valley Authority tells a similar story: “Approximately 40 percent of Entergy-MISO flows will flow over the TVA system, overloading between 12 and 70 transmission facilities. Initial cost estimates to remedy this situation range up to $500 million.” (Protest of TVA, p.5, filed Jan. 22, 2013.)

TVA adds that in private discussions, MISO has said that it “has not conducted any reliability studies focusing on integrating Entergy into its market and the resulting possible shifts in flow patterns.”

Nevertheless, MISO apparently will owe no compensation to SPP for the resulting loop flows absent a renegotiation of the JOA (joint operating agreement) between the two regions, plus implementation of some sort of market-to-market protocol to rationalize the congestion imposed by this increased level of long-distance trade.

Southwest Power Pool asks in its protest to be made whole:

“SPP recently placed into service $2.9 billion of new transmission upgrades and planned $6.7 billion of future upgrades for its members’ benefit. MISO’s use of these facilities to integrate Entergy was not a part of the analysis.” (SPP protest, p.11.)

But Entergy, ITC, and MISO answer that FERC has no jurisdiction to review the JOA, or other issues concerning uncompensated loop flows and internal SPP operations, in any of the Entergy-ITC-MISO merger or tariff proceedings now on file at FERC:

“Their arguments have no relation to the merger [and] do not deal with the integration of the transmission assets into MISO.” (See, Answer and Motion for Leave to Answer, ITC Holdings, Entergy Services Inc., and MISO, p.13, FERC Dkt. EC12-145 et al., filed Feb. 1, 2013.)

Instead, as the deal-makers claim, those issues must be raised only raised only in a future FERC proceeding dedicated directly to amending the SPP-MISO JOA, which wouldn’t even begin until after MISO and SPP had first concluded their own bilateral negotiations, so as to present a set of proposed JOA amendments to the commission for approval.

SPP counters that the JOA renegotiation must proceed simultaneously with FERC’s review of the merger. Otherwise, SPP argues, FERC will have “no way” of measuring all the impacts:

“The commission must know how the market flow and market-to-market calculations will be revised and how firm flow entitlements and loop flows will be addressed …

“The time has now come to confront these issues.” (SPP TOs Protest, p.11.)

But the deal’s three principals answer that SPP is the one that has dragged its feet. They claim in their February 1 answer (cited above) that SPP for more than a year had simply sat on a set of specific JOA revisions that MISO says it had proposed back in December 2011—waiting until very recently to send to MISO its own ideas on JOA reform, which MISO said it received only on January 25:

“SPP has devoted the last 18 months trying to defeat [Entergy’s] requests to join MISO in various retail proceedings, rather than respecting that voluntary choice of RTO.”

Playing Catch Up

As LS Power Transmission states in its protest against the Entergy/ITC grid asset transfer deal, “the perception in the industry is that Entergy has a long history of under-investment in its transmission system.” (Protest of LS Power Trans., p.4, FERC Dkt. EC12-145, filed Nov. 26, 2012.)

Also taking notice is the Justice Department’s Antitrust Division, which for some time has been studying whether Entergy, as DOJ suspects, “has harmed consumers” or “foreclosed … more efficient rivals from obtaining long-term firm transmission service.”

Justice says its investigation “remains open,” but added last Fall that if Entergy “follows through on commitments” to join an RTO and divest its transmission system to a third party, such measures “will address the Antitrust Division’s concerns.” (DOJ Press Release, Nov. 14, 2012.)

Jay Lewis, vice president for regulatory strategy for Entergy Services, gives no reason to doubt Entergy’s motivations for selling its wires to ITC. According to Lewis, in testimony he supplied in the merger case before FERC, Entergy’s transmission business going forward is a money loser: a negative cash flow business “for the foreseeable future.”

Lewis continues: “The EOCs [Entergy Operating Companies] face significant capital pressures today, and these are expected to increase over the next decade and beyond as a result of the need to make significant investments in transmission, generation and distribution …

“If the EOCs do not consummate the ITC transaction, they expect the need to finance new capital expenditures of nearly $13 billion in the next seven years, 2012 through 2018.

“The anticipated expenditures are more than 85 percent of 2011 total aggregate rate base.” (See Direct Testimony of Jay A. Lewis, Exh. ETR-200, pp.4-12, FERC Dkt. EC12-145, filed Sep. 24, 2012.)

Moreover, MISO’s plan for integrating the Entergy transmission lines into the Midwest regional grid concedes that the disparity between the high degree of grid planning and investment in the MISO region, versus the Entergy footprint, will require a five-year transmission period, just for catching up. During that time, MISO won’t impose any cross-regional allocations for construction costs of its multi-value project portfolio between the new North and South planning areas.

Otherwise, as MISO explains, “the First Planning Area may end up subsidizing the cost of projects in the Second Planning Area that have not been comparably planned to ensure regional benefits.

“Conversely, the Second Planning Area could wind up bearing a share of prior and exiting projects in the First Planning Area that were not planned to benefit the Second Planning Area.” (See, MISO Tariff Applica.,transmittal letter p. 6, FERC Dkt. ER12-480, filed Nov. 28, 2011, conditionally accepted by FERC Order, April 19, 2012, 139 FERC ¶61,056.)

And in case that’s not entirely clear, the protest from LS Power fills in the blanks:

“MISO members did not want to bear a share of the cost of projects aimed at raising Entergy’s infrastructure to a level that is more comparable with the rest of MISO.”

Importantly, however, ITC claims it’s ready, willing, and able to come to the rescue: to raise and spend the capital needed to bring its new Entergy-area grid subsidiary up to snuff.

In its merger application to win authority to acquire the Entergy grid, ITC promises to boost grid investment in the Entergy footprint to match what it’s already accomplished with its other operating companies, which took over the transmission assets of Detroit Edison in 2001, Consumers Power (METC) in 2006, and Iowa’s Interstate Power & Light (ITC Midwest) in 2007 (see Figure 1).

ITC President and CEO Joseph Welch, also testifying on the deal to acquire the Entergy grid, touts his company’s “singular focus” on wires.

Welch testified that Entergy will benefit from ITC’s financial strength, operational excellence, and “total dedication to being a good, independent steward of the electric transmission grid …”

Added Welch: “I have a passion for electric transmission.”

QFs and Rate Hikes

One of the biggest ratepayer benefits expected from MISO membership comes from the assumption that the more than 3,000 MW of PURPA-qualified QF capacity now located in the territories of Entergy’s Louisiana, Texas, and Gulf States utility subsidiaries will become firm resources: that is, they will become market participants in MISO and will bid in the RTO’s competitive day-ahead and real-time energy markets, rather than simply exercise their PURPA rights to sell power to the local utility at the utility’s avoided cost.

In fact, with QFs enjoying access to MISO markets, the Entergy retail utilities presumably would have the right to apply to FERC to be relieved of their mandatory obligation to purchase QF power at avoided cost, a move expected to generate considerable cost savings for Entergy’s retail ratepayers.

As the New Orleans City Council had observed in its order from last November granting authority to Entergy’s New Orleans subsidiary utility to join MISO, Charles River Associates had recognized this idea as “a key driver of trade benefits” when it conducted its second RTO study for Entergy, this one completed in March 2011 and examining possible MISO membership. (See New Orleans City Council Resolution R-12-439, Docket No. UD-11-01, Nov. 15, 2012.)

Moreover, last year, as a condition of granting authority to join MISO, the Louisiana PSC had directed Entergy Louisiana and Entergy Gulf States Louisiana both to 1) reform their state-level, QF avoided-cost tariffs and 2) file an application at FERC to be relieved of their QF mandatory purchase obligation. (See, La. PSC Order No. U-32148, June 28, 2012, 298 PUR4th 189.)

That, in turn, has led those two utilities to seek authority from the PSC to impose a new tariff giving QFs one of two options: a) retain the right to force utilities to buy QF power at avoided cost, but forgo any right to sell any power in MISO markets (the “Behind-the-Meter” option), or; b) register and participate as a seller in MISO markets, but give up the statutory QF “put” right to sell to the local utility at avoided cost (the “Hybrid” option). (See, La. PSC Dkt. U-32628, filed Nov. 30, 2012.)

This move by two Entergy utilities seems to stem directly from a MISO white paper (“Qualifying Facilities (QF) Generator Readiness for MISO Reliability Coordination and Market Integration,” Oct. 10, 2012), which announced that in order to maintain the integrity of MISO’s security constrained economic dispatch, any Entergy retail customers that own generation—such as QFs—would have only “two possible configurations for interacting with their local utility.” Those two configurations are of course, the very same BTM and Hybrid options.

Now comes another moving part.

Earlier this year, Occidental Chemical Corp., owner of an 835-MW QF cogeneration facility at its Hahnville, La., chemical plant site, located adjacent to and interconnected with Entergy Louisiana transmission facilities, filed a complaint at FERC against MISO, charging that MISO’s Entergy integration plan will “vitiate” QF rights and stand in violation of PURPA and FERC’s interpretive regulations. (See, Occidental Chemical v. MISO, FERC Dkt. EL13-41, filed Jan. 17, 2013.)

Occidental notes that as recently as last July, it entered into an agreement with Entergy Louisiana to sell energy at avoided cost. It also adds that as of the complaint filing date, none of the Entergy operating companies had filed applications at FERC to terminate their mandatory purchase obligations, but that even if they had, that relief wouldn’t apply to existing obligations. (Complaint at pp.9-10.)

On the question of possible rate hikes for Entergy’s retail ratepayers, ITC CFO Cameron Bready testified that his company’s acquisition of Entergy’s transmission network would yield “modest” increases in wholesale transmission rates for ratepayers in the four state-specific transmission pricing zones proposed to be created to effectuate Entergy’s integration into MISO: 2.5 percent, 1.4 percent, 8.1 percent and 2.7 percent for Louisiana, Texas, Arkansas, and Mississippi, respectively.

MISO’s 12.38 percent return on equity (set by FERC in 2002 and most certainly now out of date) exceeds Entergy’s 11 percent ROE for wholesale grid service provided through its FERC-regulated tariff. Yet this fact didn’t figure in Bready’s analysis. Rather, as Bready explained, with Entergy eventually joining MISO, the 12.38 percent ROE would prevail across the Entergy footprint regardless of who owned the wires.

Thus, as Bready argued, the transaction’s rate effects should be defined as those caused solely by the merger: a) the higher rates stemming from ITC’s planned 60/40 (equity/debt) capital structure, more costly than Entergy’s nearly 50/50 ratio, and b) savings from ITC’s claimed ability to borrow capital more cheaply than Entergy, at a 3.5-percent interest rate, as compared to 6 percent.

Bready’s analysis failed to satisfy either the Louisiana PSC or a group of protesting public power utilities from Arkansas, and Mississippi, calling themselves the “Joint Customers.”

Citing sources such as the Value Line Investment Survey and AUS Utility Reports, the PSC and Joint Customers showed how ITC’s claimed 60-percent equity structure for its various operating companies—ITC Transmission, METC, ITC Midwest, ITC Great Plains—was actually a product of double leverage. The parent company, ITC Holdings, was roughly two-thirds debt-financed.

As the Arkansas PSC explained, “what appears as common equity on the balance sheets of the subsidiary companies … is financed with a substantial amount of debt issued at the parent company level.” (Protest of La. PSC, p.18, FERC Dkt. EC12-145, filed Jan. 22, 2013.)

The effect, said the Joint Customers, was for ITC Holdings (the parent) to borrow money at 3.5 percent, convert that to equity in the hands of its operating subsidiaries, and then earn a 12.38-percent ROE through a guaranteed, formula-based rate. (Joint Customers protest, p. 23, FERC Dkt. EC12-145, filed Jan. 22, 2013.)

“ITC,” they added, “continues to seek to have ratepayers charged an equity return on borrowed funds.”

The Joint Customers admitted that FERC of late has declined to adjust rates to account for double leverage, but remained adamant:

“After having the facts of ITC’s financing [and] ratemaking scheme clearly exposed,” they argue, “the commission cannot continue to be a willing participant in it.”