A regulatory model for resource parity between supply and demand.

Brian Hedman is an executive director at the Cadmus Group and Jill Steiner is a principal.

To be truly effective, integrated resource planning must give equal play (“comparable” treatment) to both supply- and demand-side resources. But that task can prove difficult. Direct comparisons can pose challenges, owing to the sometimes counter-intuitive nature of demand-side management (DSM), versus the more conventional notions of what such resources truly are.

We use the term DSM to refer to both energy efficiency and demand response programs. These programs provide incentives for customers to use energy more efficiently or to shift the time period in which they use it. In so doing, they can reduce the utility’s future obligation either to provide energy or to stockpile capacity to meet demand. But DSM’s characteristics differ from supply-side alternatives.

One key difference concerns the physical attributes of a supply resource, versus the virtual nature of its demand-side counterpart.

Supply-side resources are tangible. They typically take the form of a large-scale asset. The utility frequently owns the plant and earns a return on investment supplied by shareholders. That large-scale investment typically is sufficient to trigger a general rate case to roll the costs into the utility’s prices.

DSM programs, by contrast, represent a larger number number of smaller investments. They are insufficient individually to trigger a general rate case. They don’t typically create a regulatory asset booked on the utility’s balance sheet. And without such treatment, there’s no return on investment for shareholders. Further, DSM programs reduce future sales, whereas supply-side resources provide additional energy to serve increased sales.

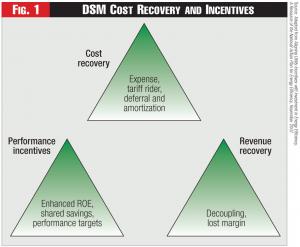

These different characteristics have led regulators to treat the two classes of resources differently. More importantly, however, to ensure a level playing field for both demand- and supply-side resources, regulators must address three key issues:

• Recovery of program costs, including administration, marketing, and incentives;

• The effect of reduced future sales; and

• Shareholder expectations.

Figure 1 - DSM Cost Recovery and Incentives

Figure 1 - DSM Cost Recovery and Incentives

Regulators aren’t blind to these ideas, however, nor are researchers or policymakers.

As far back as 1989, the National Association of Regulatory Utility Commissioners (NARUC) passed a resolution citing the need to “align utilities pursuit of profits with least-cost planning.” The resolution urged its member state commissions to: “consider the loss of earnings potential connected with the use of demand-side resources; adopt appropriate ratemaking mechanisms to encourage utilities to help their customers improve end-use efficiency cost-effectively; and otherwise ensure that the successful implementation of a utility’s least-cost plan is its most profitable course of action.”1

Twenty years later, in 2009, the Lawrence Berkeley Lab released a study stating the same concern in slightly different terms: “A key issue for state regulators and policymakers is how to maximize the cost-effective energy efficiency savings attained while achieving an equitable sharing of benefits, costs and risks among the various stakeholders.”2 (See sidebar “Missouri Shows Us.”)

These issues will only grow in importance. Recently the U.S. Energy Information Administration (EIA) indicated that $5.5 billion was spent on electric DSM programs in 2011, representing 1.5 percent of total electric retail revenues. It’s clear that DSM has grown to have a significant effect on utility planning and rate structures. Optimizing the ratemaking treatment of DSM remains vital to giving comparable treatment to demand- and supply-side resources.

DSM Cost Recovery

Figure 2 - Utility Decoupling Mechanisms

Figure 2 - Utility Decoupling Mechanisms

Utilities and regulators commonly employ three mechanisms for recovering direct DSM program costs: expensing, deferral accounting, and contemporaneous recovery.

Few jurisdictions continue to treat DSM as a simple operating and maintenance expense, because this traditional ratemaking method can create a disincentive for the utility to maintain or increase DSM spending between rate cases, as only those costs incurred during the test period of the rate case are allowed in rates. The reason is simple. In between rate cases, any upward variance from costs projected in the test period erodes the bottom line due to regulatory lag, while reducing DSM spending below the rate-case level will boost returns for utility shareholders.

The second method, deferral accounting, overcomes that disincentive. Utilities receive permission from regulators to defer and capitalize their DSM expenditures and amortize them into rates over time, earning the same rate of return on the deferred balance as for any other capital asset, or in some cases, a bonus rate of return. On the balance sheet, these deferred expenditures are treated as a regulatory asset. Amortization of the capitalized balance typically begins the year after the expense is deferred or at the time of the next rate case. The amortization period can be negotiated or can be tied to the expected lives of the DSM measures.

Nevertheless, this regulatory asset often is seen as less firm than other physical assets. It might be treated differently for accounting and tax purposes. And some stakeholders have raised concerns that market conditions or changes in future rate recovery proceedings might render such regulatory assets unrecoverable. Consequently, capitalization fell from favor during the restructuring period in the 1990s. Nonetheless, this method today is seeing a resurgence, as capitalization and amortization most closely matches the treatment accorded to supply-side resources, and provides the basis for other potential incentives.

Figure 3 - State Regulatory Mechanisms for Recovering DSM Costs

Figure 3 - State Regulatory Mechanisms for Recovering DSM Costs

The third mechanism for recovering DSM expenditures is contemporaneous recovery. Many jurisdictions have moved to or are planning to adopt this mechanism in an effort to support development and acceptance of DSM activities. In some cases, these result in a legislated system benefits charge (SBC); in others, they’re proposed by utilities and noted in the form of a line item on the customer’s bill—a tariff rider. Typically, an SBC is set as a percentage of the bill or a fixed $/kWh. The total revenue collected by the SBC determines the ceiling—e.g., the budget—for the DSM programs.

In the case of tariff riders, the budget is determined by the integrated resource planning process or by expenditures needed to meet renewable resource standards or other targets. This budget is then converted to a line item on the utility bill, set at a level to recover the expenditures on an annual basis. Any over-collection or under-collection is accrued and added to the following year’s budget. The line item charge is adjusted annually to recover that year’s expected expenditures plus any carryover.

Overall, this third mechanism provides the utility with assurance that prudently incurred DSM expenditures will be recovered in the year they’re incurred. Prudence is typically determined by a cost-benefit analysis of the proposed programs at the time the programs are implemented, and reviewed periodically through an evaluation, measurement, and verification process. Historical expenditures are generally recovered even in the event that a program fails a cost-effectiveness test, but the program is either modified to become cost effective or eliminated prospectively.

Recovering Lost Margin

Successful DSM programs reduce the utility’s sales from what they otherwise would’ve been. This shortfall contrasts with the increased sales expected from supply-side resources. Thus, while the costs of a supply-side resource and a demand-side resource might be identical, those costs will be spread across dissimilar volumes of energy sales.

Further, utility prices typically recover a portion of the utility’s fixed costs through the volumetric portion of the rate structure. Consequently, the decline in sales associated with successful DSM programs can cause an under-recovery not only of current operating costs, but also of the utility’s authorized fixed costs. Three basic classes of mechanisms are available to address the potential under-recovery of fixed costs: lost-revenue adjustments, decoupling, and straight fixed-variable pricing. Figure 2 shows which states have implemented or authorized decoupling and other methods for recovering lost revenues.

The first class of methods, lost revenue adjustments, appears straightforward—but only on the surface. Lost revenues are calculated by multiplying the decline in sales attributed to the programs by a pre-determined fixed-cost component of the energy price. The lost revenues so calculated are either deferred into a regulatory asset and amortized during the next general rate case, or are recovered through a surcharge on the current rates, similar to the contemporaneous recovery of DSM program costs. This method is attractive as it tends to isolate the effect of the DSM program. However, implementation in practice has proven difficult. Calculating the lost revenue requires agreement on the sales impacts of the programs as well as the fixed component of the overall price structure, both of which can be contentious. A lost-revenue approach also creates a disincentive for utilities to support non-utility DSM efforts, such as state funded rebates and codes, that will reduce sales but won’t be counted toward the lost revenue. Lost revenue mechanisms were popular during the early ’90s but their application has declined due to these difficulties.3

The second class, decoupling, expands the concept of lost-revenue recovery to a symmetrical treatment for fixed costs. Fixed costs don’t vary with sales and are decoupled from variable costs to be recovered separately. In concept, decoupling consists of a determination of fixed costs and a basis for fixed-cost recovery, typically the number of customers. The total revenue allowed to be recovered by the utility in a given period is determined by adding the allowed fixed costs (number of customers times the fixed-cost recovery rate) plus the variable costs (units of sales times the variable cost rate). The difference between the calculated revenues allowed to be recovered and the actual revenues received during a given period accumulates in a balancing account, which is either refunded to or recovered from customers in the subsequent period through a decrease or increase to rates.

Decoupling reduces the disincentive to support non-utility DSM efforts and creates a more stable revenue stream.4 Because decoupling mechanisms don’t differentiate between changes in sales due to the DSM programs, weather, economic conditions, or other factors, they can be less contentious and simpler to implement than a lost-revenue adjustment mechanism. Decoupled rates can exhibit higher volatility during periods of extreme weather or economic conditions. If the rate adjustments are capped to avoid this volatility, the associated balancing account might grow to unrecoverable levels in a sustained economic downturn.

The third approach, called straight fixed-variable pricing (SFV), deals with problems caused when a utility relies on volumetric sales revenues to recover fixed costs. Utility costs consist of components that vary with the volume of energy sold, such as fuel and purchased power, and components that are fixed, such as capital costs and associated maintenance. Typically, however, utility rates recover a portion of the fixed costs in the volumetric charge—leading to the potential for over-or under-recovery of fixed costs due to fluctuations in sales. Under SFV, however, the utility recovers fixed costs through a monthly customer charge, and recovers variable costs through a per-unit energy charge. One SFV variation creates tiered rates with all of the fixed costs recovered in the first tier. This first tier is set at a level such that all customers typically consume more than that amount. Subsequent tiers are reduced to the level of variable costs. This results in declining block pricing.

SFV most closely reflects economic theory for matching cost with revenue, but it too has a number of practical drawbacks. Fully recovering fixed costs in a monthly charge will decrease the variable portion of the rates, which could lead to increased energy use—or thwart efforts to increase efficiency—because the incremental cost of using additional energy is reduced. Further, monthly bills for lower-use customers would increase significantly as their bills will now reflect a larger portion of fixed costs. These drawbacks have typically restricted the use of SFV to distribution-only companies whose costs are largely fixed in nature.

Shareholder Incentive Mechanisms

In order to place DSM investments on a level basis with supply-side investments, it’s not enough simply to recover the costs of the DSM programs and the lost margin; the earnings potential for the investment also must be considered. Utilities face capital constraints and must allocate expenditures where the use of their capital is maximized. DSM expenditures compete for capital with supply-side expenditures.

Utility investors earn a return on investments in utility owned assets. Typically, DSM programs don’t produce a utility owned asset. Consequently, there might be no earnings associated with DSM programs. That can produce a bias toward supply-side investments. To allow DSM programs to be compared directly with utility owned supply-side resources, a variety of incentives can be employed that allow shareholders to earn a return on the DSM program expenditures. These mechanisms fall into three categories: shared savings, bonus payments, and enhanced return on equity. Some jurisdictions are using a combination of of all three.

The first category, shared-savings mechanisms, provides a shareholder return based on a percentage of the net benefits generated by the DSM programs. (Net benefits is the difference between the utility’s program cost and its avoided cost.) The mechanisms vary by the calculation of the amount to be shared and the percentage of the net benefits retained by the utility. Typically the savings amount to be shared is based on the total resource-cost net-benefits calculation. Shared savings mechanisms usually specify a minimum threshold that must be achieved by the utility before any benefits are retained. Penalties also can be included for performance that fails to achieve the minimum threshold.

Nevertheless, disputes can arise over the choice of method to calculate or estimate both net benefits and avoided costs. Are savings achieved on a deemed approach (predetermined), or an evaluated approach (actual measurement)? Are avoided costs higher or lower than the level that was forecast at the time of implementation?

The second category, bonus payments for performance targets, rewards the utility for meeting certain DSM program goals. The mechanisms vary greatly in their structure but typically set a minimum threshold that must be achieved before any incentive is awarded. In some cases penalties are also meted if minimum thresholds aren’t achieved.

The incentives can be a percentage of spending, a fixed amount per unit of energy saved, or a percentage of net benefits. For example, California’s incentive mechanism metes out a per-unit savings penalty for failure to achieve 65 percent or more of the DSM target, no reward for 65 percent to 85 percent of target, and tiered awards of 1 percent to 12 percent of net benefits for up to 125 percent of the DSM target. The mechanism also has a total dollar cap.

In Colorado, the natural gas performance bonus is a combination of achieving the performance targets and minimizing the cost per unit saved. A bonus factor is calculated by multiplying 50 percent of the difference between the percentage of the performance target and a threshold level of 80 percent times the ratio of the actual cost per therm saved and the budgeted cost per therm saved. The bonus factor is multiplied times the cost of the program with the final bonus capped at the lesser of 20 percent of expenditures or 25 percent of net benefits. The mechanism thus strives to encourage increased savings and reduced program costs.

Under the third category, regulators might authorize an enhanced rate of return on the deferred balance remaining after the utility chooses to defer and amortize its DSM expenditures. Until 2010, when the state moved to a tariff rider approach, Nevada authorized an additional 5 percent equity return on deferred balance of DSM expenditures. Legislation authorizes enhanced returns as a performance mechanism in several jurisdictions, but currently no state is employing the enhanced ROE shareholder incentive mechanism.

A Balanced Future

An optimal energy system contains a mix of demand- and supply-side resources. Such a mix should produce the most cost-effective, reliable, and environmentally responsible portfolio—but only if regulators ensure that utilities will remain indifferent in choosing between supply-and demand-side options.

This indifference can best be guaranteed, however, if regulators pursue a combination of policies: reasonable cost recovery, effective compensation for revenues lost to falling sales, and viable incentives for shareholders—incentives commensurate with earnings opportunities on the supply side.

Endnotes:

1. Resolution in Support of Incentives for Electric Utility Least-Cost Planning, NARUC, July 27, 1989.

2. Financial Analysis of Incentive Mechanisms to Promote Energy Efficiency: Case Study of a Prototypical Southwest Utility, LBNL-1598E, March 2009.

3. A September 2011 ACEEE survey of lost revenue mechanisms reports the mechanisms are seeing a resurgence of interest, primarily in jurisdictions with limited DSM program implementation experience.

4. In some jurisdictions the implementation of a decoupling mechanism has been accompanied by a reduced authorized return to reflect this stability.