The strong correlation holds lessons for power marketers, who naturally will build large short positions on delivery service.

David Foti works at Accenture (formerly Andersen Consulting) and is a frequent contributor to Public Utilities Fortnightly.

Observers have likened recent increases in power prices in some regions to a "perfect storm" — a quirky confluence of tighter reserve margins, higher prices for generation fuel stocks such as natural gas, and (dare I say it) exploitation of short-term efficiencies by energy marketers.

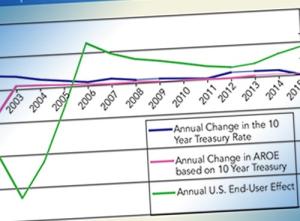

These and other events have driven retail energy prices up around the country.1 Yet, at the same time, an environment of historically low interest rates partially has offset the magnitude of these commodity-based increases for retail customers by exerting downward pressure on rates for electric transmission and distribution (T&D) services. A strong correlation between interest rates and prices for these "wires" services implies a direct financial impact for every customer of a U.S. investor-owned utility.

The Interest Rate Connection

Interest rates drive retail T&D rates in a variety of different ways, from cost-of-debt to option valuation for hedging purposes. One of the more direct effects, and the one that will be examined, is the interest rate captured in the allowed return on equity (AROE) for transmission and distribution prices. T&D prices in most jurisdictions currently are determined by cost-of-service (COS) ratemaking and are expected to remain so into the future. The COS method dictates that a utility can recover all its costs plus a reasonable rate of return on invested capital.